A surety bond is a legally binding contract ensuring one party keeps its promise to another. If someone fails to keep their promise, a surety company will compensate the party who experienced the loss. Then the party at fault for breaching the contract will have to pay the surety back.

Confused? Hey, that’s okay! That’s what this article is for – to guide you through the basics of bonds and explain exactly how these contracts work for everyone involved. By the end, you’ll understand what surety bonds are, how they work, why they’re necessary, and when you may need one.

Table of Contents (Click to Jump)

- Surety Bond Definition

- How do surety bonds work?

- Who needs surety bonds?

- How much do surety bonds cost?

- What are the most popular types of bonds?

- How do you get a surety bond?

- How long will it take to get a surety bond?

- Who do surety bonds protect?

- Frequently Asked Questions

- ZipBonds Will Cover All Your Surety Bond Needs

Surety Bond Definition

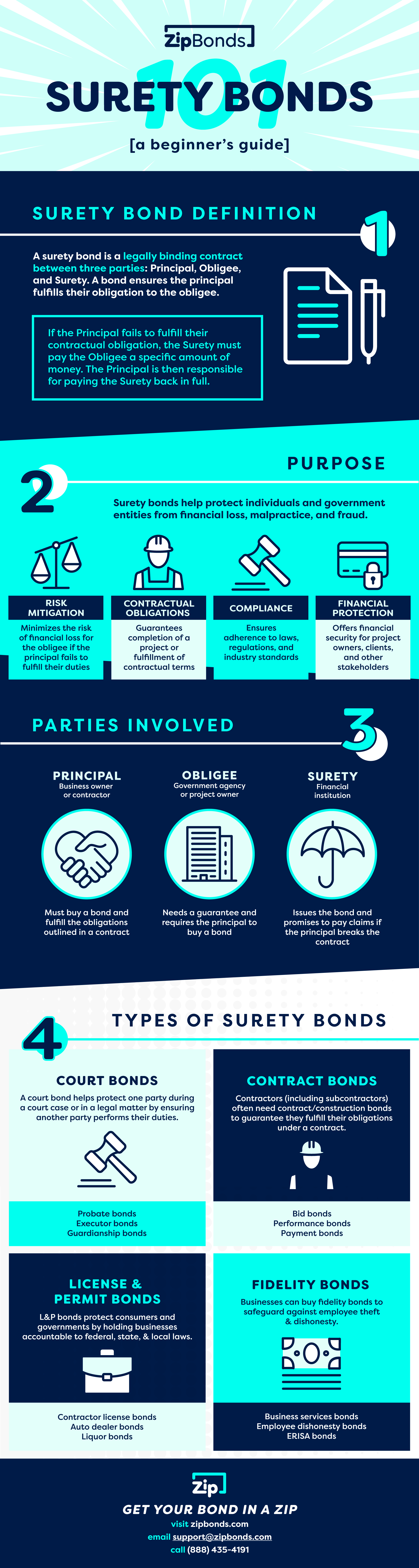

Three different parties are involved in surety bonds: a principal, an obligee, and a surety. Let’s break each of these down and explain their role in a bond agreement.

1. Principal

The principal is the person (or company) responsible for fulfilling the obligations outlined in a contract. They must purchase a bond to guarantee the quality of their work performance. The principal is often a business owner.

2. Obligee

The obligee is the party that needs a guarantee (contract) that the principal will fulfill their obligation. They will require the principal to purchase the bond. The bond acts as a safeguard for the obligee if the principal fails to execute the contract. The obligee is often a government agency or project owner.

3. Surety

The surety (or guarantor) issues the bond and guarantees that the principal will fulfill their obligations. The surety assumes the responsibility of paying the debt owed if the obligee fails to meet the contract. They’re like the middleman – working with the principal and the obligee.

Putting it all together…

Surety bonds tie all three parties together through a legally binding contract. The bond assures the obligee that the principal will come through for them and abide by specific laws. If the principal fails to meet their obligation, the surety will step in to cover damages or losses the obligee experiences – more on that in the next section.

How do surety bonds work?

Surety bonds help protect individuals and government entities from financial loss, malpractice, and fraud. If the principal fails to fulfill their contractual obligation, the surety must pay the obligee a specific amount of money. The bond acts as a form of credit. The principal is responsible for paying the surety back for any claims made on the bond.

When the principal fails to fulfill their promise, the obligee can make a claim on the surety bond to recover their losses. The surety will examine the claim to see if it’s valid. If it is, the surety company will pay the obligee, and the principal will then owe the surety company for that amount.

Here’s an example…

A governmental agency called CoolGov (obligee) hires a construction company called Happy Contractors (principal) to build a rooftop patio for employee happy hours. Happy Contractors is required to obtain a construction performance bond to ensure they fulfill the contract terms. Happy Contractors will contact a surety provider called ZipBonds to purchase the bond.

The new surety bond protects CoolGov by guaranteeing Happy Contractors’ work performance. If Happy Contractors fails to fulfill their obligation, CoolGov will make a claim on the bond, and ZipBonds will step in to compensate CoolGov for their losses. Happy Contractors must then pay back ZipBonds for the claim and any associated costs.

Who needs surety bonds?

If you’re a contractor, licensed professional, or company seeking government work, you may be required to get a bond. You can check your industry’s federal, state, or local regulations to learn about your surety bond requirements. (Or, to make things easier, give us a quick call, and one of our agents will research the information for you!)

Many individuals and businesses in different industries need bonds. Here are some common examples:

- Contractors: Construction contractors, including general contractors and subcontractors, often need contract bonds to guarantee they will fulfill their obligations under a contract.

- Businesses with licenses: Many companies must obtain a bond as part of their licensing or permitting process in a state, city, or county. Auto dealerships, mortgage brokers, contractors, cannabis distributors, and freight brokers all need license and permit bonds.

- Individuals involved in court and probate matters: Various types of court and probate bonds guarantee that individuals will carry out their legal duties.

- Public officials: Some public officials, such as notaries, may need to obtain a bond as a requirement of their position.

- Service providers: Home health care providers and janitorial companies often need bonds to assure clients that they will perform their services legally and ethically.

How much do surety bonds cost?

The cost of a surety bond (called a premium) varies depending on the bond type, the bond amount, and the surety company’s risk assessment. In general, the cost of a bond is between 1% and 5% of the bond amount. For example, a $10,000 bond might cost between $100 and $500.

Surety companies will assess your risk and determine the bond amount you need. They will consider your credit score, financial stability, and experience. You are more likely to score a lower premium rate if you have a good credit score and financial stability.

Here are some examples of typical premium rates for a few different bonds:

- Contractor license bonds: 1-15% of the bond amount, depending on the contractor’s creditworthiness and the bond amount required

- Auto dealer bonds: 1-10% of the bond amount, depending on the dealer’s creditworthiness and the bond amount required

- Notary bonds: $50-$150 per term, depending on the state and bond amount

You can shop around for bond providers to find the best rates and terms available. Working with a reputable and experienced surety bond provider can help ensure you get the best value for your investment.

Check out our guide to learn more: “How Much Does a Surety Bond Cost?”

What are the most popular types of bonds?

There are four main categories of surety bonds: contract (construction), license and permit, court, and fidelity bonds.

About two-thirds of all bonds are written for contractors. The government or project owner will ask a contractor to fulfill a contract, and the contractor will obtain a bond to guarantee their performance.

Common types of contract surety bonds include bid bonds, payment bonds, performance bonds, and warranty (maintenance) bonds. As a general rule of thumb, contractors must obtain contract bonds for any federal projects worth $150,000 or more.

License and permit bonds protect consumers and governments by holding businesses accountable to federal, state, and local laws and regulations. Companies in various industries must obtain these bonds before conducting business with customers.

The principals in these types of bonds are often contractors, auto dealers, liquor stores, notaries, and other licensed professionals.

Court bonds help protect individuals or companies during court cases. Plaintiffs, defendants, and estate administrators use these types of bonds. Four of the main types of court bonds are administrator bonds, attachment bonds, guardianship bonds, and cost bonds.

Businesses can buy fidelity bonds to safeguard against employee theft or dishonesty. They can help protect companies, employees (past and present), trustees, partners, and directors. Fidelity bonds include business service, employee dishonesty, and ERISA bonds.

Companies that deal with expensive items or large amounts of cash – like casinos – often need fidelity bonds. Businesses that hire mass numbers of employees or have employees who make home visits may also require them.

How do you get a surety bond?

An applicant (the principal) can obtain a bond by paying a surety provider a premium. The principal must sign an indemnity (compensation for losses) agreement, committing to reimburse the surety if the obligee files a claim. The principal must pledge their company/personal assets when signing the contract.

While some insurance companies sell surety bonds, it’s wise to find a company specializing in surety bonds over general insurance providers. Check out our blog post, “Where to Get a Surety Bond [3 Best Options],” to learn why this is essential.

In a nutshell, direct surety providers hyper-focus on different types of surety and can provide you with more options, better rates, and expertise that you won’t typically find elsewhere.

The Small Business Administration (SBA) also has a Surety Bond Guarantee Program to guarantee certain types of bonds.

How long will it take to get a surety bond?

The time it takes to get bonded depends on the bond type and complexity of the underwriting process. Some bonds can be approved within minutes, while others take a few hours, days, or even weeks. It’s essential to have all necessary documentation ready and to work with a reputable surety bond provider to help expedite the process.

Factors that impact the time it takes to get a bond:

- Bond type: Some types, such as contractor bonds, are more complex than others and may take longer to process.

- Bond amount: The larger the bond amount, the more time it may take to process the bond.

- Surety provider’s workload: If a surety company is busy, it may take longer to process a bond application.

- Your credit score and financial stability: You are more likely to get a surety bond quickly if you have a good credit score and financial stability.

Who do surety bonds protect?

As you’ve probably gathered by this point, surety bonds don’t protect the bondholder (the principal or owner of the policy). This sets surety bonds apart from insurance policies. Bonds protect other parties if the bondholder (the principal in the bond contract) costs them money by breaking the law, acting dishonestly, or failing to perform their duties or complete a project.

Surety bonds can also compensate for unpaid taxes, wages, or other damages. In some cases, surety bonds may protect consumers or the general public from harm caused by the actions of a bonded party.

The surety company that issues the bond is responsible for paying out any valid claims made against the bond. After a claim is settled with the claimant, the surety will seek reimbursement from the principal.

Frequently Asked Questions

In many cases, you can still get a surety bond even if you have a low credit score. Surety companies will consider your credit score when determining your premium. Still, they will also consider other factors, such as your financial stability, experience, and the type of bond you need. If you have a low credit score, you may need to pay a higher premium.

The purpose of a surety is to provide a financial guarantee or assurance that a party (the principal) will fulfill its obligations under a contract or law.

A surety is an insurance company that agrees to be responsible for another party’s debts, defaults, or failures. The surety’s responsibility is to provide compensation or remedy if the principal fails to fulfill their obligations to a third party – the obligee.

Sureties are commonly used in construction, finance, and government industries, where the financial stakes can be high, and the risks of default or non-compliance are significant.

A surety limit is the maximum amount of money a surety company is willing to pay on behalf of a principal if the principal fails to fulfill its obligations under a surety bond. The surety company determines the limit based on several factors, including the principal’s creditworthiness, the type of bond, and the amount of risk involved.

- For example, a contractor bond may have a surety limit of $1 million, which means that the surety company would be liable for up to $1 million if the contractor fails to complete a project on time and within budget.

The purpose of a bond is to provide financial protection and security for the party requiring the bond, the obligee. The bond ensures that the obligee will be compensated if the bonded party, the principal, fails to fulfill their contractual obligations or comply with laws and regulations.

The bond guarantees that the principal will act with honesty and integrity and fulfill their obligations as outlined in the bond agreement. In this way, surety bonds help to mitigate financial losses and protect against fraud and other forms of misconduct. If the principal knows they are personally liable for up to the surety limit, they are more likely to fulfill their obligations under the bond.

Some benefits of surety bonds include:

- Helping businesses and individuals get contracts, obtain licenses and permits, and access financing

- Protecting people and organizations from financial loss

- Ensuring contractors, fiduciaries, and others will fulfill their obligations

- Making the financial system more efficient and accessible

- The surety is the insurance company or financial institution that issues the bond and agrees to pay the obligee if the principal fails to fulfill their obligations.

- A bond is a legal document that guarantees the surety will pay the debt or obligation if the other person or organization fails.

ZipBonds Will Cover All Your Surety Bond Needs

Zip Bonds can help you identify which bonds you need to fulfill your obligations. We offer the fastest and most secure option for getting bonded. Our all-digital platform is intuitive and straightforward. Apply online, email support@zipbonds.com or call (888) 435-4191 to speak with an agent directly.