Indemnity is a common term in the surety bond and insurance industries, but it can be confusing. What’s the real meaning behind it? Is an indemnity bond the same as a surety bond, or are there differences between the terms?

Today, we’re going back to the basics. Consider this your Indemnity Bonds 101 Guide. By the end, you’ll be able to use the term more confidently and better communicate with your surety and insurance providers.

What does indemnity mean?

Indemnity is basically compensation for loss or damages. Legally, the term often refers to exemption from being held responsible (liable) for damages (Investopedia). However, in surety and insurance, indemnity is a contract between two parties. One party agrees to pay for any damages another party may cause.

- In insurance, this agreement is between the insurance company and the policyholder (insured).

- In surety, it’s between the surety provider and the policyholder (principal). But instead of compensating the policyholder (like insurance does), the surety provider agrees to pay a third party – called an obligee. An obligee is a party that could suffer loss or damages due to the principal’s failure to perform. The obligee may file claims against the principal’s bond for compensation.

Here’s one more way to look at it. Indemnity is an essential part of what makes up a surety bond. It’s the component that compels one party to compensate another. For example, the obligee may file a claim, and the surety will be compelled to pay them to settle that claim. Then, the principal will be compelled to reimburse the surety for the same amount.

What is an indemnity bond?

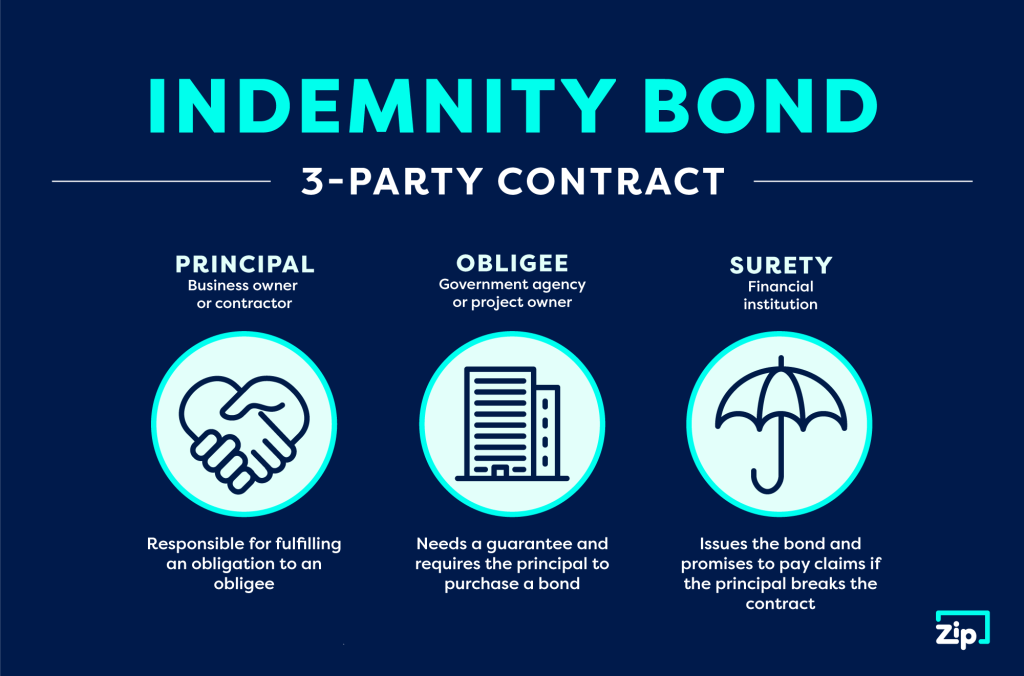

As a reminder, a surety bond is a three-party agreement between:

- A principal (the party responsible for fulfilling an obligation to an obligee),

- An obligee (the party that requires the surety bond), and

- A surety (the company that issues the bond).

All three parties are tied together in a legally binding contract that guarantees the principal will fulfill their obligations or face bond claims. You can learn more in our previous article, “What Is a Surety Bond?”

Indemnity Bond Meaning

In short, an indemnity bond is any surety bond that protects an obligee against losses resulting from a principal’s failure to perform. The surety is responsible for compensating the obligee for the cost of the damages. Then the principal is held liable to repay the surety in full.

The purpose of an indemnity bond is to restore a party (the obligee) to its original financial status after they suffer a loss or injury.

If you’re confused about any of the terms we use throughout this article, check out our handy Surety Bond Glossary for more help!

What is the difference between a surety bond and an indemnity bond?

At this point, you’re probably wondering, “Are surety bonds and indemnity bonds the exact same thing?” That’s a great question, and the answer is “almost, but not quite.”

Not all surety bonds are indemnity bonds (though almost all are). However, all indemnity bonds are surety bonds. That’s because most bonds have “indemnity” – that compelling factor we mentioned earlier that gets one party to compensate another – written into them. This is called an “indemnity agreement” – a section included on a surety bond form.

The principal must sign the indemnity agreement to purchase a bond from a surety. The agreement legally binds the principal to the contract with the surety. By signing, the principal agrees to accept the financial responsibility of any valid claims that arise. In other words, this agreement protects the surety financially and “indemnifies” the obligee if the principal breaks the contract.

When is an indemnity bond required?

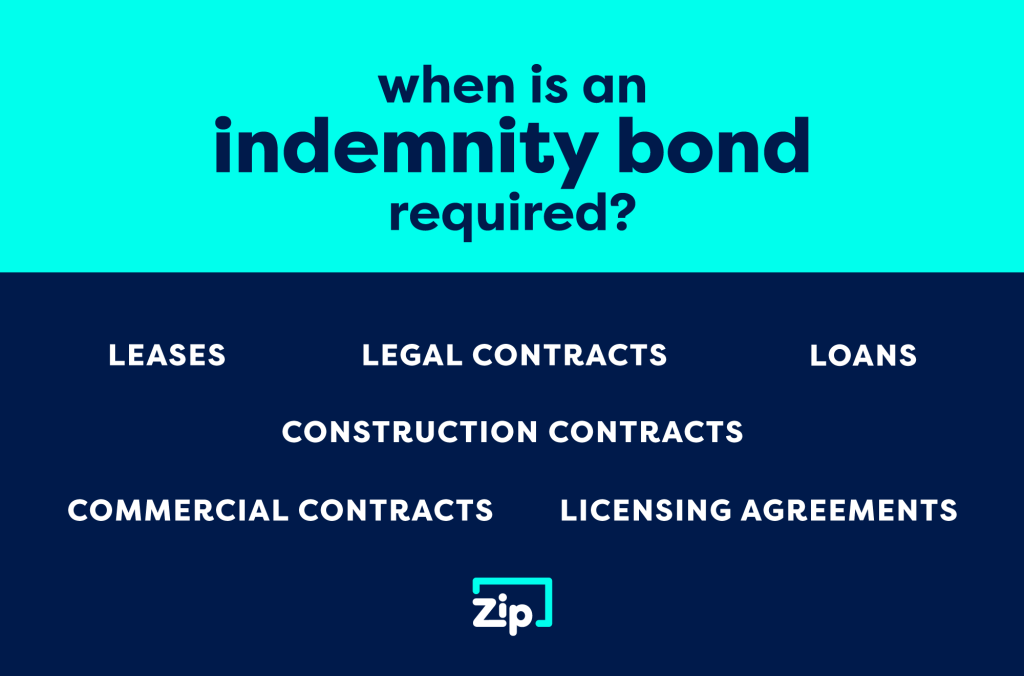

There are various types of indemnity bonds and reasons you may need one. If you work in the construction industry, you may need an indemnity bond (called a contract bond) to take on a new project and carry out various parts of the construction process. You may also need a surety bond to get a license to work as a professional in your state, city, or county.

In the next section, we’ll dive a little deeper into the types of indemnity bonds. But in general, you could need an indemnity bond to enter any of the following types of agreements with another party:

- Leases

- Loans

- Legal contracts

- Commercial contracts

- Construction contracts

- Licensing agreements

Types of Indemnity Bonds

Here are the main categories of surety bonds that include indemnity agreements.

License and Permit Bonds

License and permit bonds (or commercial bonds) ensure businesses abide by contracts and federal, state, or local laws and regulations. Companies from various industries may need these types of bonds to begin and continue operating a business legally.

Construction Bonds

Construction bonds (or contract bonds) protect project owners and investors throughout the course of a construction project. They ensure contractors complete projects according to contract terms.

Court and Probate Bonds

Sometimes the courts or a judge will require a court or probate bond to ensure someone properly carries out their assigned duties. For example, an estate bond guarantees that an executor fulfills their legal responsibilities of distributing an estate for someone who has passed away.

Fidelity Bonds

Fidelity bonds are like insurance policies. They protect employers from damages their employees may cause clients.

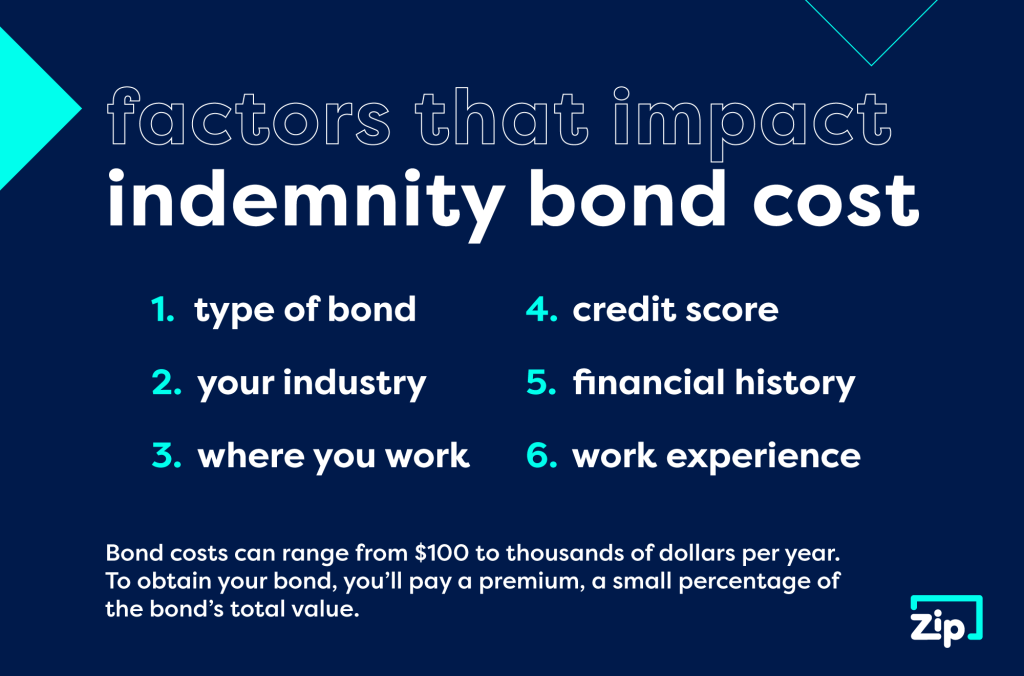

How much does an indemnity bond cost?

The cost of your indemnity bond will depend on the type of bond you need, your industry, where you work, your financial history, and credit information, among other things. Bond costs can range from $100 to thousands of dollars per year. To obtain your bond, you’ll pay a premium, a small percentage of the bond’s total value.

For many (but not all) surety bonds, your credit score will play a prominent role in your premium rate. Typically, the better your score, the lower your rate. For example, if you need a $10,000 bond and have excellent credit, you could get bonded for as little as 1%, or $100.

Other Frequently Asked Questions

What is a general indemnity agreement, and why do I need to sign one?

A general indemnity agreement is a contract between an indemnitor (the principal) and a surety company. The indemnitor agrees to accept responsibility for losses or expenses the surety company must cover on the principal’s behalf. In plain talk, that means the policyholder (of the surety bond) agrees to reimburse the surety company for any expenses they cover due to the policyholder’s failure to perform their contractual duties.

Why does my spouse need to sign the general indemnity agreement?

In most cases, assets are held jointly with your spouse (if applicable). This may include owning a home together, having joint bank accounts, titles to vehicles, etc.

What does a lost cashier’s check have to do with an indemnity bond?

If you lose a cashier’s check, your bank will require you to purchase an indemnity bond (called a lost instrument bond) before issuing a new check. Since the bank is financially responsible for the cashier’s checks they issue, the bond ensures that someone doesn’t falsely report a missing check and then cash both the original and the duplicate. It also protects the bank if someone intercepts the check illegally redeems it. The bank can file a claim on the indemnity bond to recover any losses they suffer.

Apply for an Indemnity Bond with ZipBonds

Contact the ZipBonds team to apply for your surety bond today! We offer thousands of bonds, including court and probate, construction, fidelity, and license and permit bonds. You can always reach us by calling (888) 435-4191 or emailing support@zipbonds.com. We’ll help you get bonded in a zip!