Surety bonds are a type of financial guarantee that protects the obligee (the party owed money or something of value) from financial loss if the principal (the party obligated to pay) fails to fulfill their contractual obligations. Surety bonds are used in various industries, including construction, healthcare, and government contracting.

Most bonds cost around 1-10% of the total bond amount. Let’s take a closer look at how surety bond costs are calculated and whether you can get bonded with bad credit.

How much does a surety bond cost?

The bond amount is the maximum amount the surety company will pay out if someone files a claim against the bond. The cost of the bond – the premium – is usually a percentage of this amount.

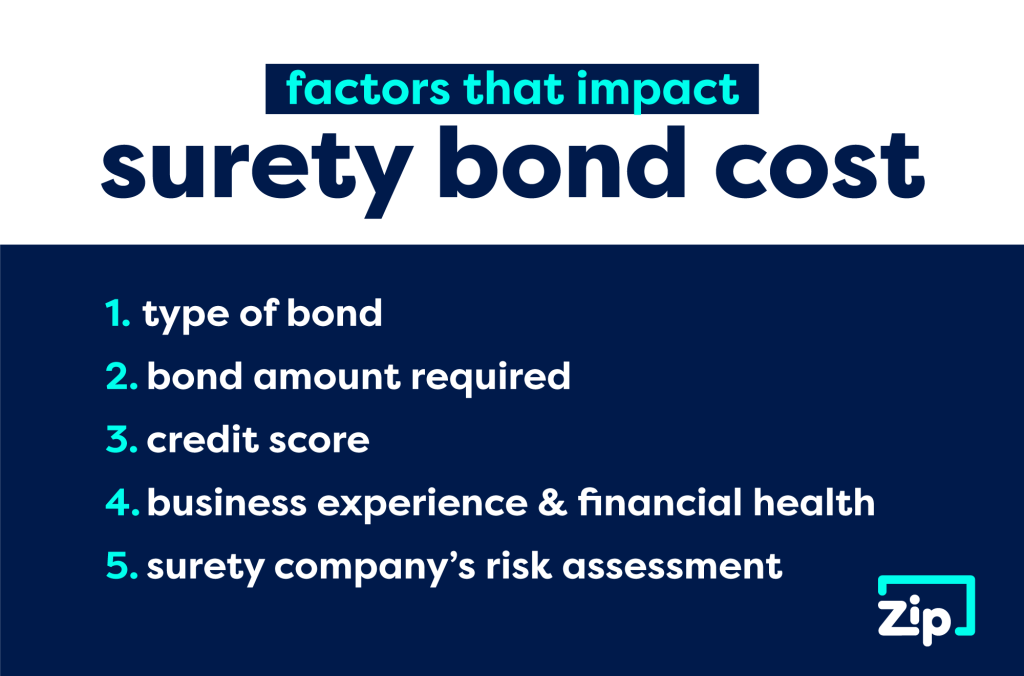

The cost of a surety bond is determined by several factors:

- Type of bond

- Bond amount

- Principal’s creditworthiness

- Surety company’s risk assessment

Generally, you can expect your surety bond to cost between 0.5% and 10% of the total bond amount. This means a $10,000 bond could cost anywhere from $50 to $1,000.

Who sets the price of a surety bond?

The surety company that issues the bond sets the price. Each company has a formula for calculating bond premiums, considering various factors.

What factors impact the price of a surety bond?

Several factors can impact the price of a surety bond, including the bond amount, the type of bond, the applicant’s credit score, and the applicant’s financial history. Generally, the higher the bond amount, the higher the premium. Let’s break each of these key factors down.

1. Type of Bond

The type of bond is the most important factor that impacts the cost of a surety bond. Some types of bonds, such as contract bonds and court bonds, can be larger and riskier to issue than others. As a result, these bonds may cost more.

2. Bond Amount

The larger the bond amount, the higher the premium will be. If you need a $50,000 bond, it will likely cost more than a $5,000 bond, for example.

3. Credit Score

The principal’s creditworthiness can also play a large role in how much a surety bond costs. Surety companies are more likely to charge higher bond premiums if applicants have low credit scores. Your credit score is a key indicator of your financial health and ability to repay the bond if needed.

4. Business Experience & Financial Health

Businesses with a proven track record in their industry may qualify for lower rates. Surety companies consider your business’s financial statements and overall financial health when determining your rate.

5. Surety Company’s Risk Assessment

Surety companies will assess the risk of loss associated with each bond and charge a premium accordingly. You can get quotes from multiple surety companies to compare prices. OR you can work with a surety provider like ZipBonds that partners with numerous sureties to find the best bond premiums for applicants.

Can I get a surety bond with bad credit?

Yes, getting a surety bond with bad credit is possible, but the premium may be higher. Some surety companies specialize in working with applicants with poor credit and may be able to offer lower rates than others.

Keep in mind that some bonds don’t require credit checks at all, so your credit score doesn’t always determine whether you can get bonded – or even your premium rate. Other options to overcome bad credit and still pay a low premium may include providing financial statements, collateral, co-signors, or funds control. Call ZipBonds at (888) 435-4191 to learn about your options.

Which bonds don’t require a credit check?

Many license and permit bonds don’t require a credit check and can be issued within minutes of applying. However, a credit check may be necessary if the bond amount is high or the applicant has a history of claims.

Which types of bonds have a fixed price?

Some types of bonds, such as title bonds, notary bonds, and many contractor license bonds, have a fixed price and don’t require a credit check. They can often be quickly issued for a low premium after application. Premiums can range by surety provider as well.

Will the cost of my bond change when I renew?

The cost of a surety bond may change when you renew it. Generally, the premium will depend on the bond amount and the applicant’s credit score at the time of renewal. If your credit score has improved or your financial history has become more stable, you may be eligible for a lower premium. However, if your credit score has decreased or your financial history has become less stable, you may be required to pay a higher premium.

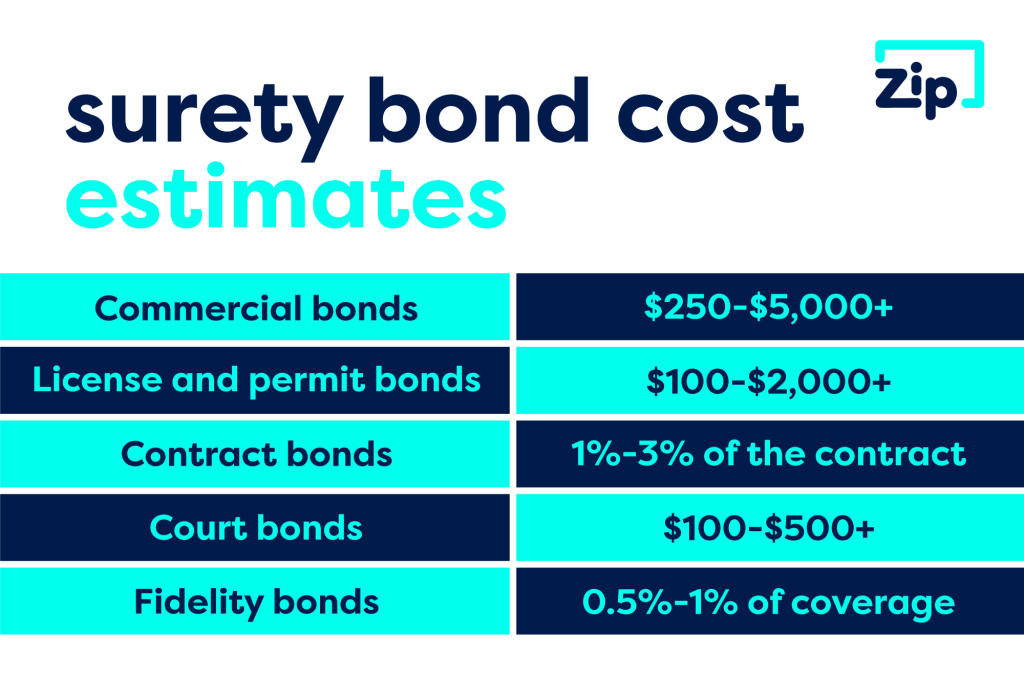

How much do different types of surety bonds cost?

Here are some general estimates for various types of bonds:

- Commercial bonds: $250 to $5,000+

- License and permit bonds: $100 to $2,000+

- Contract bonds: 1% to 3% of the contract amount

- Court bonds: $100 to $500+

- Fidelity bonds: 0.5% to 1% of the coverage amount

Please remember that these are only estimates, and the actual cost of a bond can vary. You should contact your surety provider directly if you have any questions about premium costs. They can provide you with a quote based on your specific needs.

The Surety Bond Market in 2025: What can we expect?

In 2025, the surety bond market is facing subtle but important shifts. As interest rates stabilize and construction demand evolves, underwriters are taking a closer look at financial strength, project types, and credit profiles. Expect more selective bonding decisions, modest premium adjustments, and a continued emphasis on risk mitigation. Staying informed can give you an edge in navigating the year ahead.

At ZipBonds, we’re seeing more private work being bonded, versus only public work. The pricing on bonds hasn’t been affected by the economy at this time, but underwriting guidelines are becoming a bit more strict, specifically for larger bonds. Check out the Power Producers Podcast featuring ZipBonds CEO and Co-Founder Zach Mefferd to learn more.

Frequently Asked Questions

Is the bond cost the same as the bond amount?

No, the bond cost is not the same as the bond amount. The bond amount is the maximum amount the surety company will pay out if someone files a claim against the bond. The bond cost is the amount that the applicant pays for the bond (the premium).

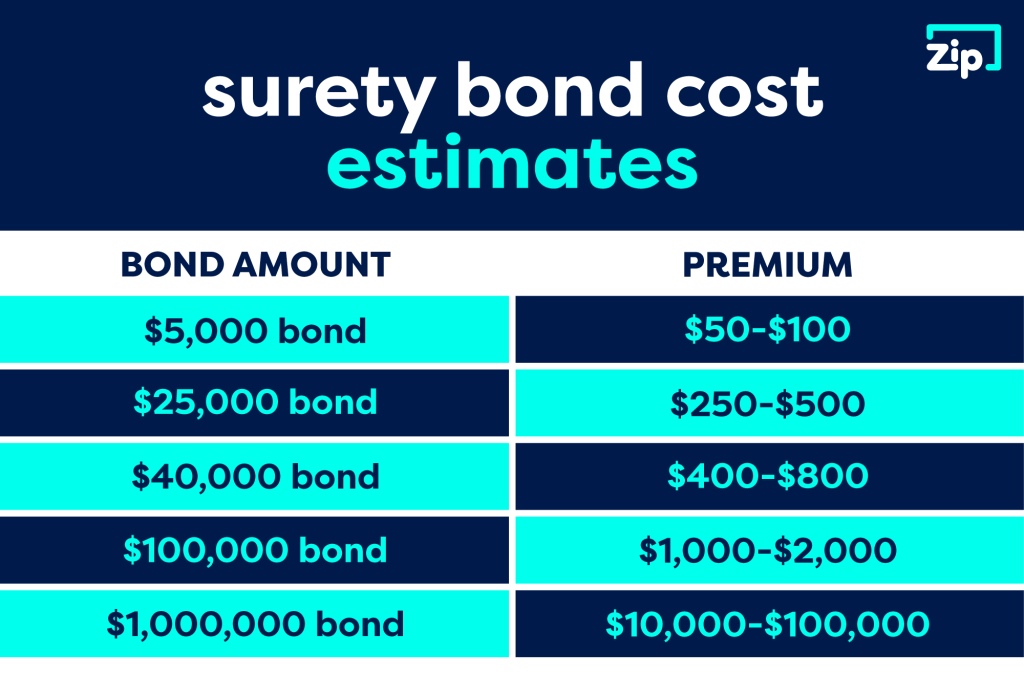

How much does a $5,000–$1,000,000 bond cost?

Here are some examples of how much different bond amounts can cost to purchase.

- A $5,000 bond typically costs $100.

- A $25,000 bond typically costs between $250 and $500.

- A $40,000 bond typically costs between $400 and $800.

- A $100,000 bond typically costs between $1,000 and $2,000.

- You can expect to pay between $10,000 and $100,000 for a $1,000,000 bond.

How can I get the best surety bond rates in 2025?

- Shop around: Compare quotes from multiple surety companies before choosing one.

- Stick with a trustworthy provider once you find one: Your business will look more stable if you form a long-term partnership versus shopping around every year. A good provider will be able to match you with the best options for your situation.

- Improve your credit score: A good credit score can significantly lower your premiums.

- Strengthen your financial statements: This demonstrates your financial stability to the surety company.

- Consider an instant rate: If you need a bond quickly, an instant rate may be the best option, even if it’s slightly higher than a quote rate.

Get a Surety Bond Quote from ZipBonds

The experts at ZipBonds can help you obtain the bond you need quickly. To connect with one of our team members, please call us at 888-435-4191 or email us at support@zipbonds.com. We’ll walk you through the process for the bond you need so you can be on your way!