Most people have heard a cautionary tale about contracted work. Apprehensions toward contracted work exist in both the personal and business worlds. You may have even had a bad experience with a contractor yourself at some point. Websites like Angie’s List (now Angi) became popular to help people safely identify professional contractors with proven track records of quality work.

A contract bond offers financial protection to shareholders, taxpayers, investors, and even the public. Read on to learn what a contract bond is, who needs one, how they work, and the most common types you’ll run across in the construction industry.

Contract Bond Definition

What is a contract bond?

A contract bond guarantees that one party fulfills the terms of their contract with another party. Contract bonds are primarily used in the construction industry for public works projects or large private construction jobs. They ensure contractors fulfill their performance and payment obligations to project owners.

Other terms for contract bond include the following:

- Construction bond

- Performance and payment bond

- Contractor bond

- Bond for construction

How does a contractor bond work?

A contract bond financially protects the obligee (the party who benefits from the contract) if the contractor defaults on their obligations. The obligee can file a claim on the bond to recover financial losses. Contract bonds help ensure that projects are completed on time and within budget and that subcontractors and suppliers are paid for their work.

There are different types of contract bonds, including performance bonds, payment bonds, and bid bonds, each with specific terms and conditions.

Parties to a Contract Bond

A contract bond involves three parties:

- Principal: The contractor who must obtain the bond and fulfill a contract

- Obligee: The party that requires the contract and can file claims if the principal breaks it

- Surety: The party that issues the bond and promises to back it financially if the contractor breaks the contract

Who does the contractor bond protect and how?

If the contractor (principal) breaks their contract by failing to make required payments to subcontractors or perform what they’ve promised, the obligee can file a claim. The surety will step in to ensure the claim is settled. If they have to cover for the contractor upfront, they will seek reimbursement for all costs later on.

Check Your Pre-Qualification in 3 Minutes!

Who needs a contract bond?

The purpose of a contract bond is financial assurance that a job will be completed in accordance with a competitive bid or without financial disruption. Government or public jobs often require contract bonds as part of the bidding process. Private companies may also require contract bonds as part of a guarantee for their investors.

Government Contracting Law: The Miller Act

The Miller Act, enacted in 1935, requires contractors to furnish construction bonds when working for the federal government if the contracted work exceeds $100,000. This law was established to protect taxpayers and the federal government from financial interruptions associated with contracted work. The bonds help assure concerns such as the solvency of a contractor and the contractor’s ability to complete the contracted work.

State or municipality project contracts may also require bonds not subject to the Miller Act’s $100,000 minimal value. This means they can require bonds even if the jobs are less than $100,000.

Private Construction Projects

Private sectors using general contractors for company operations may also require performance bonds. These bonds limit project owners’ risk and allow contractors to tackle larger projects.

ZipBonds was selected as an expert by Redfin, who featured us in their recent article: 9 Steps to Take If Your Contractor Quits in the Middle of a Job | Redfin

Why is a construction bond required?

A construction bond is required to protect the project owner (or another obligee) if the contractor defaults on their obligations. Common reasons for construction bond claims include failing to complete a project on time or within budget or failing to pay subcontractors and suppliers as promised. The bond ensures that the project owner will receive compensation for any losses or damages incurred because the contractor failed to perform.

How much does a contract bond cost?

The cost of a construction bond depends on several factors, including the size and complexity of the project, the contractor’s creditworthiness, and the specific bond type. Typically, construction bond premiums range from 1-3% of the total bond amount. For example, if the bond amount is $100,000, the premium may fall between $1,000 and $3,000.

How do I qualify for a construction bond?

To qualify for a construction bond, contractors must demonstrate their ability to fulfill their contractual obligations. The bonding company will also evaluate the contractor’s creditworthiness and may require collateral or a personal guarantee.

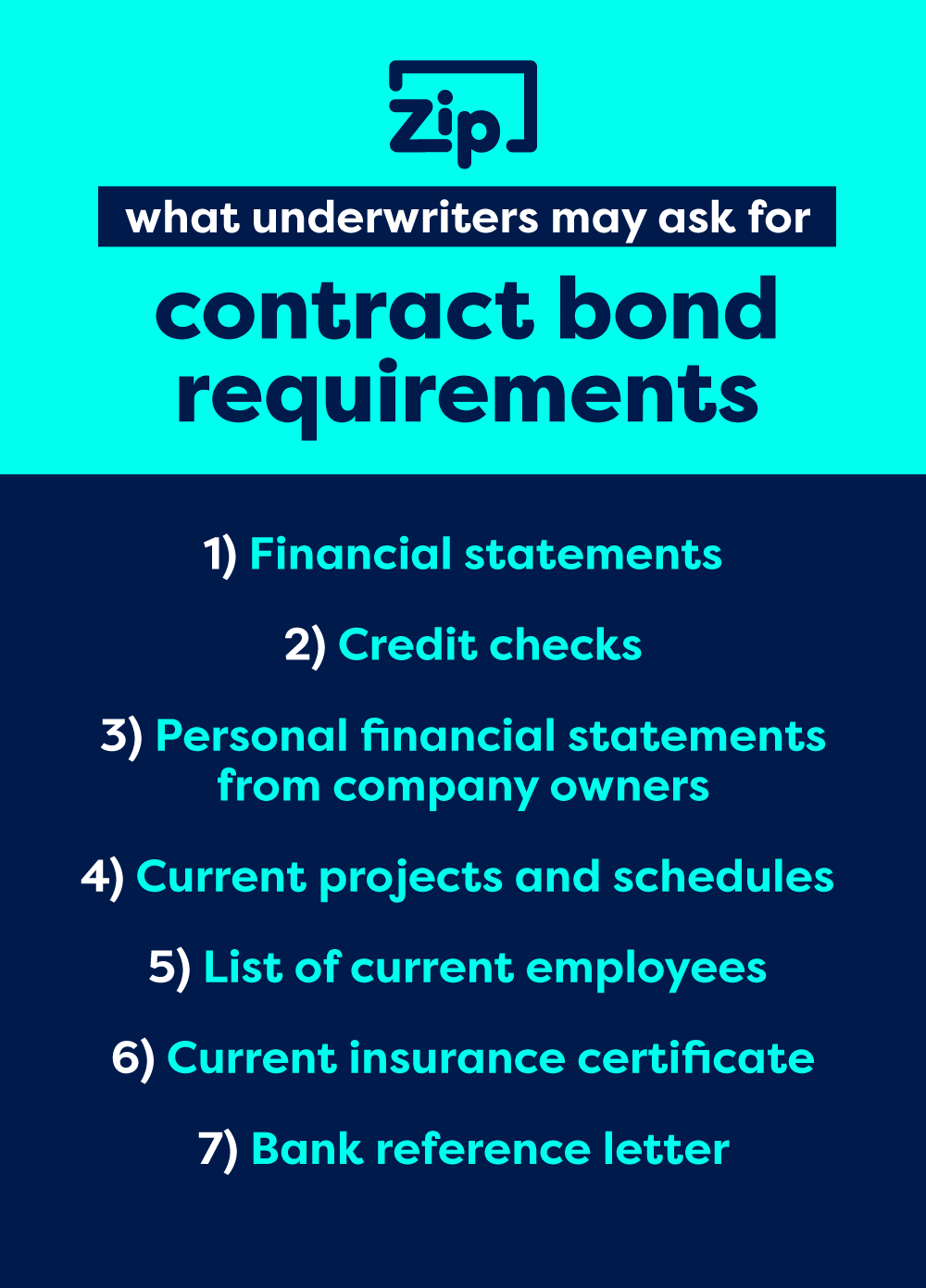

Construction Bond Requirements

Contractors are often required to pay a premium based on a percentage of the total bond amount. A contractor’s ability to get bonded will depend on their credit score and work history. This information can also affect the cost of the bond. Underwriters for construction bonds will assess a contractor’s completed contract history, the contractor’s working capital, and the contractor’s skilled ability to complete the proposed project.

Underwriters for surety providers will request verification of the contractor’s ability to work. The required information can include:

- Financial statements

- Credit checks

- Personal financial statements from company owners

- Current projects and schedules

- List of current employees

- Current insurance certificate

- Bank reference letter

Is a credit check required?

A credit check is typically required when applying for a construction bond. Bonding companies use credit checks to evaluate a contractor’s creditworthiness and determine the bond premium. Contractors with excellent credit can typically secure better premium rates than those with poor credit.

Small Builder Assistance

The U.S. Small Business Administration offers a unique service: the SBA Surety Bond Guarantee (SBG) Program. The program is designed to help small and up-and-coming businesses win contracts they otherwise may not qualify for.

The ideal candidates for this program are contractors with the required skills and know-how who lack the experience and financial assets to be securely bonded outside the program. So, if you’re in the construction, supply, or service industry and want to compete for larger contracts, the SBG program may be for you.

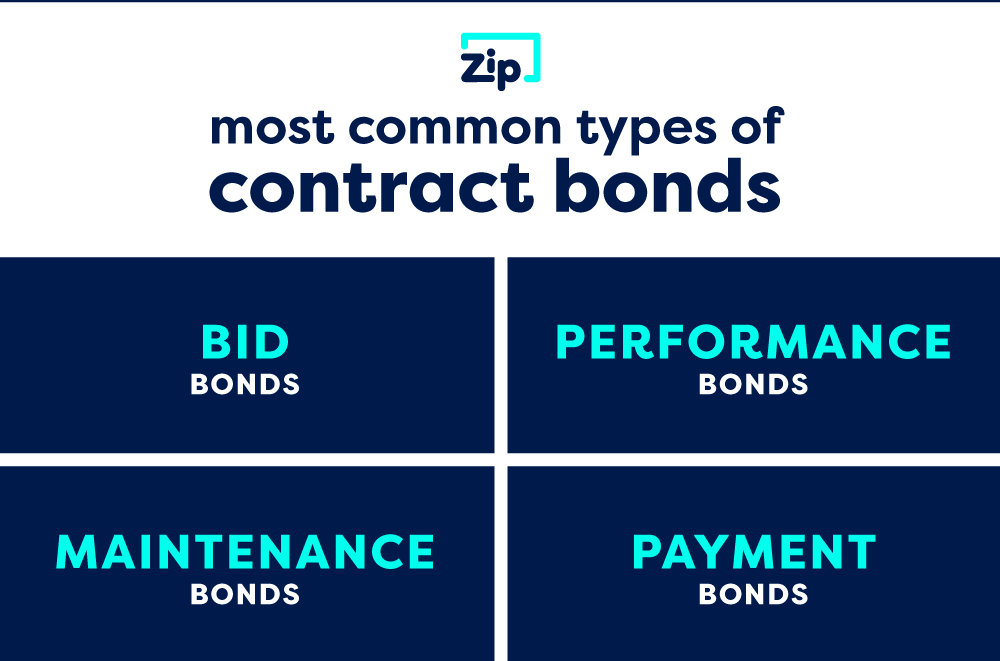

The 4 Most Common Types of Contract Bonds

There are several instances when a contract bond is necessary. These legal agreements can be used in various scenarios to assure the entity needing contracted project work. The surety company backing the bond provides the financial guarantee.

Bid Bonds

A bid bond ensures a project owner that a bidder will complete the work outlined in the job proposal bid.

Performance Bonds

Performance bonds guarantee that a principal will fulfill the agreed-upon terms of contracted work for a specific project.

Payment Bonds

Payment bonds ensure contractors or subcontractors pay their subcontractors, suppliers, and laborers.

Maintenance Bonds

Warranty or maintenance bonds guarantee against possible defects for a specific time after the completion of work.

How do payment and performance bonds work?

Payment and performance bonds are both types of surety bonds used in the construction industry. Performance bonds focus on the successful execution of the project, while payment bonds address financial obligations to those involved in the project.

Contractors often obtain payment and performance bonds simultaneously (on the same bond form) at the start of a new construction project and use them in conjunction. They replace bid bonds after a contractor wins a project.

People Also Ask

What type of bond is a contract bond?

A contract bond is a type of surety bond that guarantees a contractor will fulfill their contractual obligations.

What is another name for a contract bond?

Contract bonds are also known as construction bonds. The terms can be used interchangeably. People may also refer to these bonds using the terms contractor bond, contractor bonding, and bond for construction.

What is the difference between construction bonds and performance bonds?

Construction and performance bonds are often used interchangeably, but a performance bond is a type of contract bond that guarantees explicitly that a contractor will complete the project as outlined in the contract.

Is a construction bond the same as a bid bond?

No, a bid bond is a type of construction bond that ensures a contractor will enter into a contract if awarded the bid. A construction bond guarantees that the contractor will fulfill the terms of an agreement.

What is a guarantee of performance?

A guarantee of performance is a promise that a party will fulfill their contractual obligations. It’s typically used in construction contracts to protect the owner from the risk of the contractor defaulting on their responsibilities.

Apply for the Contract Bonds You Need Today

Ready to get pre-qualified for your contract bonds? Fill out our quick start form online or call us at 888.435.4191.