When it comes to construction projects, payment bonds and performance bonds are crucial aspects of ensuring successful completion and financial protection. In this blog post, we’ll explore the differences between payment vs. performance bonds, shedding light on their purpose, who issues them, costs, expiration, refunding, and the process of obtaining them from a surety provider.

If you work in the construction industry or are planning a construction project, you’ll likely need one or both of these bonds at some point.

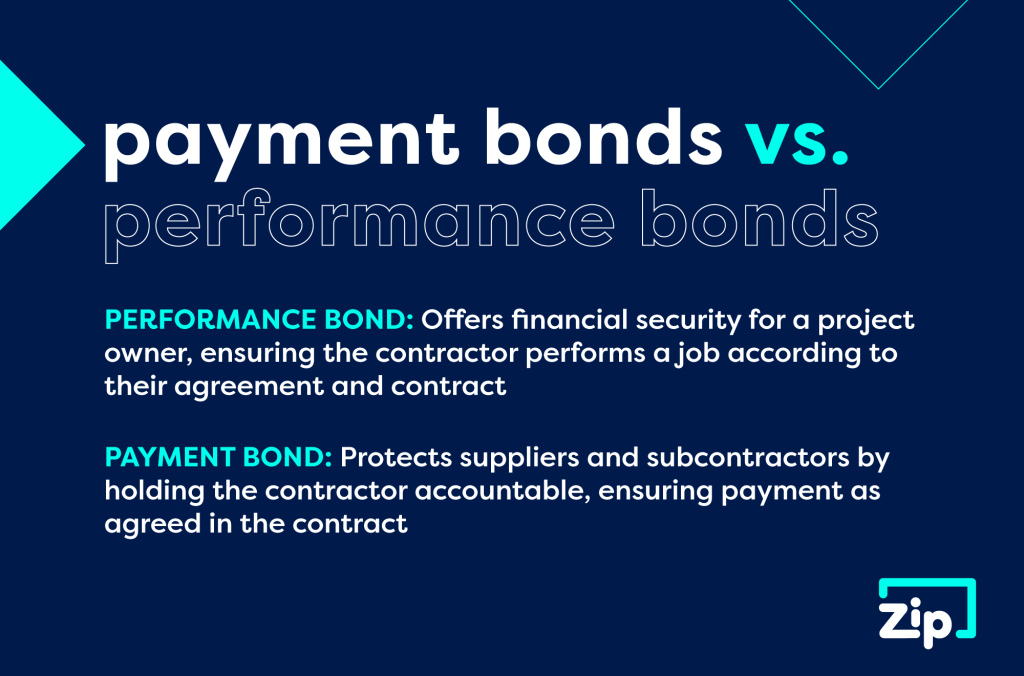

Payment Bond vs. Performance Bond

What is a payment bond?

A payment bond is a type of contract bond that assures subcontractors, suppliers, and laborers involved in a construction project are paid appropriately. It guarantees they will receive timely payment for their work and materials, even if the contractor defaults or fails to meet their financial obligations.

What is a performance bond?

A performance bond is a surety bond that safeguards the project owner or developer against losses if the contractorfails to fulfill their contractual obligations. It ensures the project will be completed as agreed, within the specified timeframe and according to quality standards.

What’s the difference between a payment and performance bond?

The key difference lies in the parties involved and the risks each bond addresses.

Bond | Payment Bond | Performance Bond |

Purpose | Protects subcontractors and suppliers | Protects the project owner |

Required to Post | The contractor | The contractor |

Who Benefits | Subcontractors and suppliers | Project owner |

Guarantee | That the contractor will pay its subcontractors and suppliers | That the contractor will complete the project according to the contract’s terms |

Purpose

Payment bonds protect the rights and interests of those providing labor and materials on a construction project (e.g., subcontractors, suppliers, and laborers). On the other hand, performance bonds safeguard the project owner’s investment and mitigate potential financial losses due to contractor non-performance.

Guarantee

Both payment and performance bonds guarantee that the contractor will fulfill their contractual obligations. However, the specific guarantees of each type of bond differ.

- A payment bond guarantees that the contractor will pay its subcontractors and suppliers for the work they do on a project. If the contractor goes bankrupt or fails to pay, the surety company will step in and pay the subcontractors on the contractor’s behalf (upfront).

- A performance bond guarantees that the contractor will complete the project according to the terms of the contract. If the contractor fails to complete the project on time or within budget, the project owner/developer can file a claim on the bond.

Who Issues Each Bond

Payment bonds and performance bonds are both issued by surety companies. Surety companies are financial institutions that specialize in issuing surety bonds.

Cost and Payment

Generally, you can expect to pay between 1% and 3% of the contract’s total value for your bond premium.

Expiration

Payment bonds typically expire once all subcontractors, suppliers, and laborers have been paid in full. Performance bonds usually expire upon the project’s completion and final acceptance by the project owner.

Refunding

These bonds are not refundable unless the project gets canceled as a whole.

How to Get Your Payment and Performance Bond

Contact a reputable surety bond provider like ZipBonds. Obtaining a payment and performance bond involves application, underwriting evaluation, providing necessary documentation, and paying a bond premium. The requirements and timelines may vary depending on the project’s size, complexity, and the surety bond provider’s procedures.

If you’re a subcontractor or supplier a contractor has not paid, you may be able to file a claim against the contractor’s performance bond. To file a claim, contact the surety company that issued the bond and provide them with evidence of your work and the amount that you are owed. The surety company will investigate your claim and determine whether to pay it. If the surety company decides to settle your claim, they will send you a check for the correct amount.

Apply for Your Performance and Payment Bond Today

Need a performance and payment bond for your next project? Gather essential information like your bid amount, bid date, business history, and credit score, and we’ll do the rest. We make the application and approval process as fast and easy as possible. Just select your state below to begin our simple bonding process. You can also just give us a call at 888-435-4191 to speak with an agent directly.

Construction Bond Quick Start Form