One of the most common risk mitigation tools in the construction industry is subcontractor bonding. As a general contractor, requiring your subcontractors to “bond back” can mitigate risk for you and the project owner, build your reputation, ensure quality, help you win larger jobs, and more!

Read on to learn how subcontractor bonding works and when to utilize this strategy.

What is subcontractor bonding?

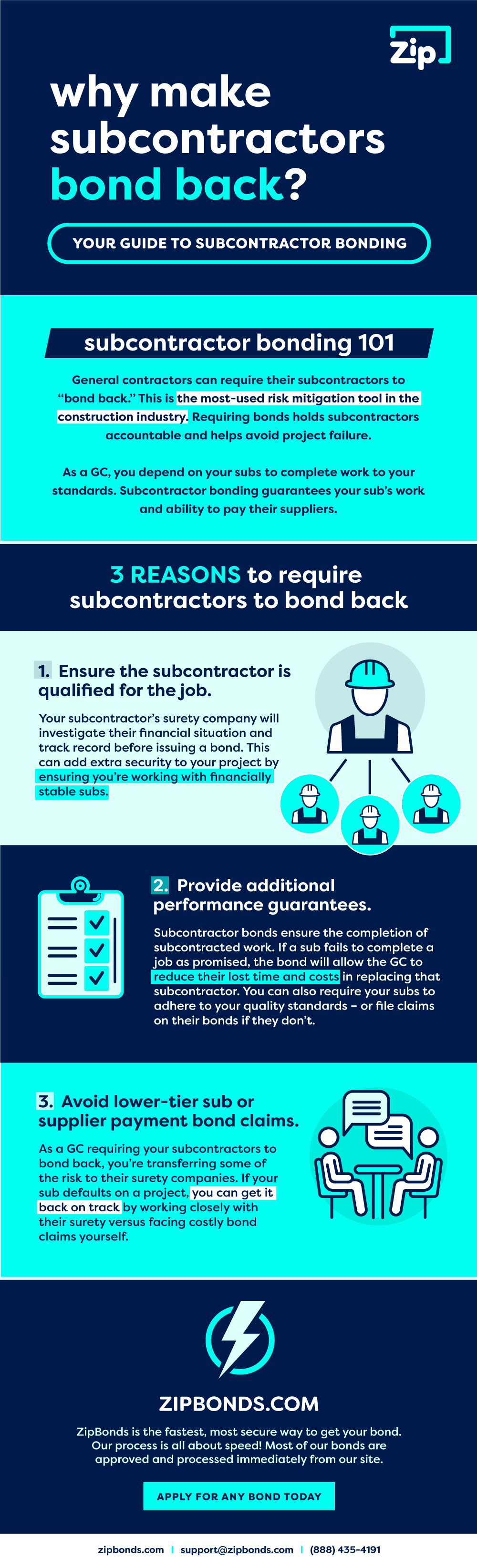

Subcontractor bonding typically occurs when a general contractor requires a sub to “bond back.” This is the most used risk mitigation tool in the construction industry – for good reason! As a GC, you depend on your subcontractors to do the work they’re hired for to your standards. Requiring construction bonds from subs working under you can mitigate risk on jobs, ensuring projects are completed as planned.

If a bonded subcontractor defaults on a project or something unpredictable happens, a surety company can recover the losses or find a substitute contractor to finish the job.

How does bonding back work?

At a basic level, bonding back is a way to guarantee your subcontractor’s work and their ability to pay their suppliers and subcontractors. Requiring bonds holds subs accountable and helps avoid project failure.

If your sub is bonded and they fail to fulfill their contract, you can file a claim on the bond for any money you lost on the project. The surety has a number of solutions they can use to get the project back on track.

Subcontractor bonds include various types of construction bonds. These are the most common, typically issued simultaneously:

- Performance bonds ensure a project is completed according to the contract.

- Payment bonds ensure a subcontractor pays its suppliers and vendors as promised.

What are the benefits of subcontractor bonding?

Subcontractor bonding can be a shrewd strategy for contractors. Here are some of the top benefits of requiring your subs to bond back.

1. Mitigate Risk

As a GC requiring your subs to bond back, you’re transferring some of the risk to their surety companies. If your sub defaults on a project, you can get it back on track by working closely with their surety.

2. Ensure Quality

Your sub’s surety company will investigate their financial situation and track record before issuing a bond. This can add extra security to your project by ensuring you’re working with financially stable subcontractors. You can also require your subs to adhere to your quality standards – or file claims on their bonds if they don’t.

3. Complete Projects

Subcontractor bonds ensure the completion of subcontracted work. If a sub fails to complete a job as promised, the bond will allow the GC to reduce their lost time and costs in replacing that subcontractor.

4. Win Larger Jobs

Contractors can increase their bonding capacity by bonding back subcontractors. If your bonding capacity is 2 million, for example, you may be able to bid on a $2.5 million job if you require all subs with trades over a certain amount to be bonded. This splits the risk among different sureties.

While the main contractor will be responsible for the entire project, they can recoup potential losses from their subs’ sureties if needed, rather than placing all the risk on one surety. Requiring subs to bond back can be a shrewd strategy for hard-to-place contract bonds.

5. Enhance Your Reputation

Bonds represent financial stability and the promise to fulfill a contract. If both the GC and the sub are bonded, project owners will have more peace of mind.

6. Protect Yourself from Unforeseen Events

The bond will cover potential losses if something unexpected happens, such as a sub getting too sick to work or a project getting shut down. If a subcontractor causes a delay, adds labor expenses to the project, or material costs increase, the subcontractor’s surety will be liable for covering the added costs.

Is subcontractor bonding worth the cost for contractors?

A common concern for general contractors is the added cost to the bid and overall project when they require subs to bond back. The subs, after all, will include the bond premium they have to pay in their price (requiring the GC to increase their bid). The cost is often minimal, however, and could save a GC a lot more money than it costs them upfront.

It can be well worth the added cost if you account for the amount of risk added to a project without subcontractor bonding. It can also give project owners extra peace of mind when considering your bid.

Which subcontractors should be bonded?

It’s wise to bond back any of your specialty subcontractors and any other sub you can’t easily replace. Also consider requiring bonds from contractors you haven’t worked with before. We recommend requiring bonds from the following subcontractors:

- Subs in major trades working on significant parts of the project

- Subs working on critical parts of the project

- Any subs you haven’t worked with before

- Subs you can’t replace easily

Is subcontractor bonding necessary for private work?

Bonding for private work has become increasingly popular. Many project owners today require bonds from their contractors. The most common bonds required for private jobs are bid, performance, and payment bonds.

Bonding for private projects can limit project owners’ risk and empower contractors and subs to win larger jobs. Some contractors miss out on “perfect projects” because they don’t have the bonds they need at the right time.

As a rule of thumb, subcontractors in major trades or trades working on essential parts of a project should be bonded, regardless of whether the job is public or private. As a general contractor, also consider requiring any subs you’re unfamiliar with to be bonded to limit your risk.

Subcontractor Default Insurance vs. Bond

What is subcontractor default insurance (SDI)?

Subcontract default insurance protects general contractors if a subcontractor defaults on a contract. The GC can file a claim with their insurance company to recoup their losses if the subcontractor defaults.

This risk mitigation tool is often used as an alternative to surety bonds. Some GCs choose this option because it allows them to determine when a sub defaults, rather than going through the claims process and waiting for the surety to investigate.

What are the main differences between SDI and surety bonds?

SDI is between a GC and their insurance company, while a surety bond is between the GC, the subcontractor, and the surety. SDI usually isn’t required, and surety bonds often are. SDI can be a good option for contractors with a large bonding capacity and financial stability, as they will take on more risk and have more subs to manage.

Surety bonds ultimately protect project owners while benefiting contractors in the ways we previously described. Sureties can also be more unbiased than insurance companies, and bonds are valuable for many public and private projects with specific completion requirements.

Apply for the construction bonds you need today!

ZipBonds offers the fastest and most secure option for getting the contract bonds you need. Our all-digital platform is intuitive and straightforward. Feel free to ask any questions or for guidance on increasing your bonding capacity.

Email support@zipbonds.com, message us on Live Chat, or call 888-435-4191! We also have a pre-qualification option for contractors that takes less than three minutes to complete. Apply online today!