It’s common for contractors to face challenges when it comes to obtaining the contract bonds needed to win, start, and finish projects successfully. Fortunately, there are several solutions for hard-to-place contract bonds.

Whether you have a large bid spread, had a rough year financially, have less-than-ideal credit, or lack the experience needed to win the projects you want, we can help. We’ve worked with our carriers to develop solutions that help contractors stay competitive, no matter their financial situation or experience. We love to make what may have once been impossible possible!

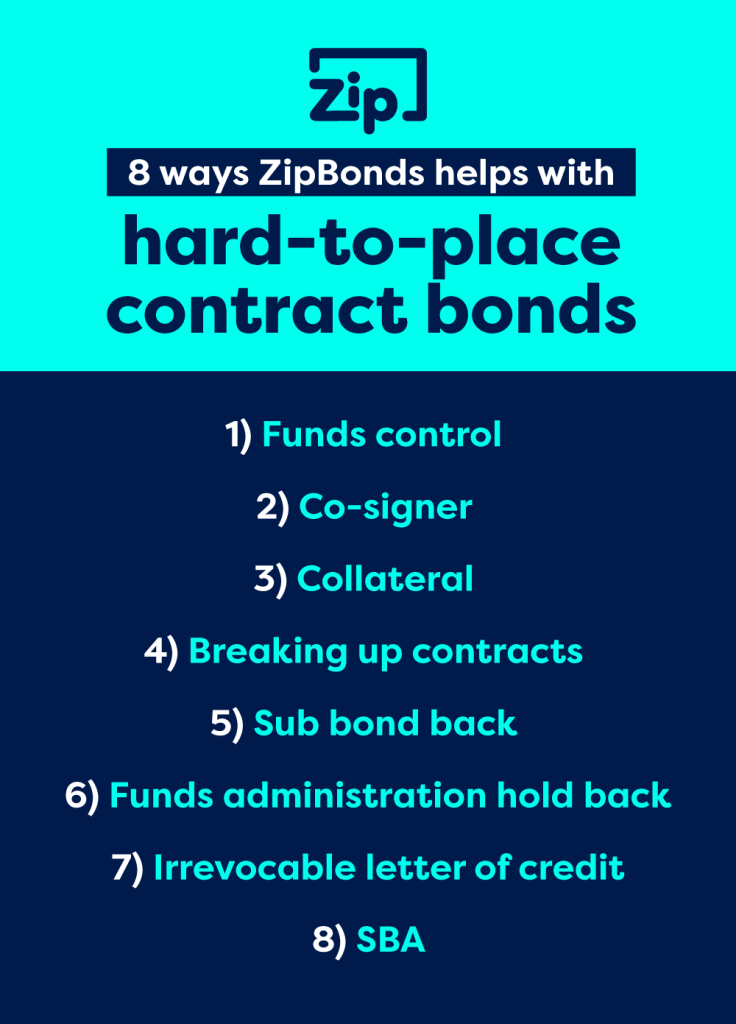

Read on for our eight top solutions for tough situations many contractors find themselves in.

What is a hard-to-place contract bond?

A hard-to-place contractor bond is a surety bond that’s challenging to secure due to the heightened risk associated with a contractor or a project. These bonds typically come into play when a contractor has one of the following:

- A less-than-ideal credit history

- Limited financial resources

- A lack of experience handling projects of similar scope or complexity

Inherently risky projects, such as those involving unique or untested construction methods, can also make obtaining a contract bond difficult.

In these cases, specialized surety companies or brokers with expertise in high-risk bonds are often required to assess the contractor’s qualifications and provide a bond that meets the project requirements.

Viable Solutions for Hard-to-Place Bonds

Here are our top eight solutions for contractors when bonds are challenging to obtain.

1. Funds Control

Funds control allows a surety company to monitor and control the flow of funds on a construction project. The contractor must receive funds from a third party, such as a funds control agent or a trust account. This process may be used to protect and reduce risk for both the contractor and the surety during the bonding process.

Funds control empowers contractors to secure bonding capacity that may otherwise be challenging to obtain due to financial limitations. It may be required when the surety has concerns about the contractor’s financial stability, previous performance, or ability to manage project funds responsibly.

2. Cosigner

Just like a cosigner on a loan, working with a cosigner for a construction bond can be a good option if the applicant has good experience but is a little light on the financial backing. It’s best to use a cosigner who has construction experience or is connected to the applicant in some way (e.g., parent, relative, long-time friend, etc.).

3. Collateral

A surety may accept collateral to back a bonded obligation. Forms of collateral include free and clear real estate, cash, or an irrevocable letter of credit (ILOC). Cash and ILOC are the most common forms, as most surety companies don’t want to deal with taking real estate as collateral (then having to sell the real estate to make themselves whole). Collateral is held for the entirety of the job.

4. Irrevocable Letter of Credit (ILOC)

An irrevocable letter of credit is a written agreement between a bank and an applicant to back the surety bond. The bank promises to pay the surety company if the surety needs to be made whole on a claim/loss.

The surety company will typically have a required form on which the bank must put the letter of credit to ensure it stays in place for a specified period. This helps provide the financial backing the surety company may need to support a project or full bond program.

5. Sub Back Bonds

This is the most used risk mitigation tool in the construction industry. If a prime/general contractor has subcontractors working underneath them, they may require their subcontractors to bond back. This helps mitigate the risk on the job for the general contractor.

Subcontractor bonds help general contractors hold their subcontractors accountable and avoid project failure. If a bonded subcontractor fails to fulfill their contract with the general contractor, the surety will remediate the situation. The surety will first pay out the claim for the general contractor to cover any losses. Then the surety will seek full reimbursement from the subcontractor.

6. Breaking Up Contracts

This method is more uncommon but can solve a single-project bonding issue. Breaking up one large contract into smaller contracts may be a good solution if a project is too large for a contractor.

This method only works if the contract is easy to break into smaller pieces. For example, if five parking lots are under one agreement, you can break it into five separate contracts. On the other hand, if there’s only one building under a contract, you can’t break it into smaller contracts. It’d be difficult to argue that it’s more than a single project.

7. Funds Administration Hold Back

This solution is a mix of funds administration and collateral. Funds administration would be used. However, the first X dollar amount needed in the holdback owed to the bond principal is then held in funds administration until the end of the job. So, if 10% is held back on a $1,000,000 job, the first $100,000 owed to the bond principal would be held by funds control for the entirety of the job.

8. Small Business Administration (SBA)

The SBA offers a unique service: the SBA Surety Bond Guarantee (SBG) Program. This program is designed to help small and up-and-coming businesses get bonded. The ideal candidates for this program are contractors with the skills and know-how who lack the experience and financial assets to be securely bonded outside the program. Recently, the SBA announced new limits for their program, which increased to $9 million for all projects and $14 million for Federal contracts.

ZipBonds is a preferred bond provider for the SBA. Read our Case Study for an example of how we solved a hard-to-place bond situation with a client.

ZipBonds Solutions for Hard-to-Place Contract Bonds

Whether you’re an agent or contractor, we’ll do all we can to get you an option. Working with a company that only does bonds allows us to move quickly and leave no stone unturned. Contact us today by calling (888) 435-4191 or emailing support@zipbonds.com to speak with one of our agents.