Surety bonds play a crucial role in fostering trust and ensuring the fulfillment of obligations in various sectors, especially in construction and infrastructure.

At ZipBonds, we understand the importance of staying informed about market trends and industry developments. Here’s an in-depth look at the current state of the surety bond market, growth trends, and industry breakdown.

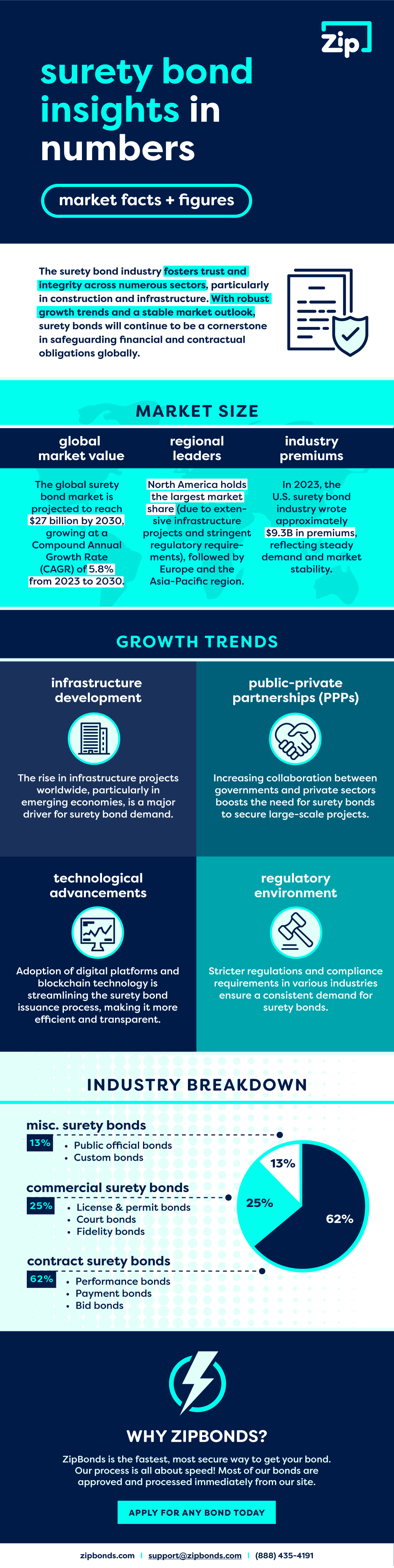

Market Size

Global Market Value

The global surety bond market is on an upward trajectory, projected to reach a value of $27 billion by 2030. This growth is driven by a Compound Annual Growth Rate (CAGR) of 5.8% from 2023 to 2030.

Regional Leaders

Among the regional leaders, North America holds the largest market share, with the United States leading due to its extensive infrastructure projects and stringent regulatory requirements. Europe and the Asia-Pacific region follow closely behind.

Industry Premiums

In 2023, the U.S. surety bond industry wrote approximately $9.3 billion in premiums, reflecting the steady demand and stability of the market.

Growth Trends

Infrastructure Development

The increase in infrastructure development projects, especially in emerging economies, is a major factor driving the demand for surety bonds globally.

Public-Private Partnerships (PPPs)

The rise in Public-Private Partnerships (PPPs) is boosting the need for surety bonds to secure large-scale projects.

Technological Advancements

Technological advancements, such as the adoption of digital platforms and blockchain technology, are streamlining the surety bond issuance process, making it more efficient and transparent.

Regulatory Environment

Stricter regulations and compliance requirements in various industries ensure a consistent demand for surety bonds.

Industry Breakdown

Contract Surety Bonds (62%)

- Performance Bonds: Ensure the completion of a project according to contractual terms.

- Payment Bonds: Guarantee payment to all subcontractors and suppliers.

- Bid Bonds: Provide assurance that a contractor will honor their bid and execute the contract properly.

Commercial Surety Bonds (25%)

- License and Permit Bonds: Required for obtaining business licenses and permits.

- Court Bonds: Ensure court-related obligations are met, such as appeal bonds and fiduciary bonds.

- Fidelity Bonds: Protect businesses from losses due to employee dishonesty.

Other Surety Bonds (13%)

- Public Official Bonds: Ensure the performance and honesty of public officials.

- Custom Bonds: Required for importing goods to guarantee compliance with customs regulations.

The surety bond industry is essential in fostering trust and integrity across numerous sectors. With robust growth trends and a stable market outlook, surety bonds will continue to be a cornerstone in safeguarding financial and contractual obligations globally.

Why ZipBonds?

ZipBonds is the fastest, most secure way to get your bond. Our process is all about speed! Most of our bonds are approved and processed immediately from our site.