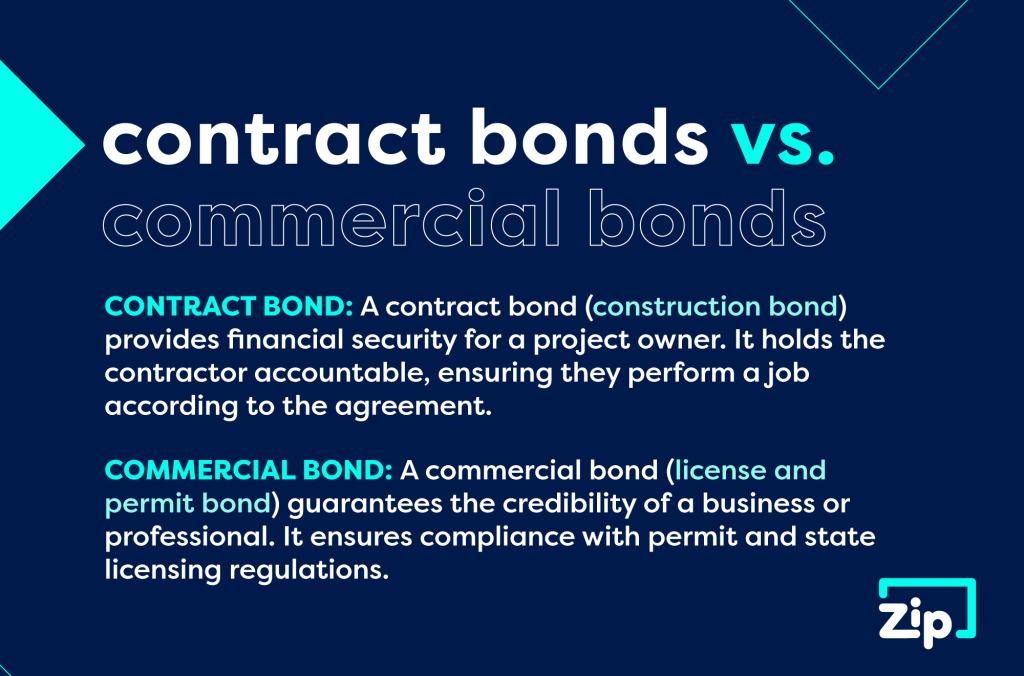

There are several types of surety bonds. Two of the main categories are contract bonds and commercial bonds, which we’ll cover today. While they have overlapping similarities, they also have some distinct differences that set them apart.

Read on to learn when and why you might need to obtain one of these types of surety bonds in your business or practice.

What are contract and commercial bonds?

Commercial and contract bonds are both surety bonds.

We covered the basics of surety bonds in depth in our last post, so be sure to check that out. Here’s a quick review.

Surety bonds are legally binding contracts involving three parties:

- Principal: The person/business required to buy the bond and fulfill an obligation.

- Obligee: The party that hires the principal to fulfill an obligation and requires the principal to purchase the bond.

- Surety: The organization that writes and issues the bond to the principal. They pledge to pay the obligee for losses resulting from the principal’s inability to fulfill their obligation.

Think of a surety like a cosigner. If the principal fails to fulfill their promise, the surety will step in and take responsibility for any financial losses. The principal, however, will be required to reimburse the surety for any money they paid the obligee if the obligee files a claim against the principal.

Are surety bonds insurance policies?

Surety bonds are similar to insurance policies in some ways, but there are some key differences.

Like insurance, the principal who obtains the bond will pay the surety a premium (fee). If the principal fails to perform their obligation to the obligee (violates the bond agreement), the obligee can file a claim. In this case, the surety will step in to pay what’s called a penal sum.

Unlike insurance, the principal will have to reimburse the surety for the entire penal sum.

What is a commercial bond?

A commercial surety bond, also known as a license and permit bond, guarantees the credibility of a business or professional. It holds them accountable for complying with permit and state licensing regulations. The premium for these bonds is typically only 1% to 3% of the bond cost.

You may be required to obtain a commercial bond before you can get your business license, depending on your industry. This bond tells the company you’ll be working for that you’ll perform ethically and according to state laws.

Unlike contract bonds, which guarantee specific performance obligations to a particular party (the obligee), commercial bonds ensure the principal complies with permit and license requirements.

Common types of commercial bonds include:

- Sales tax bond: Some businesses are required to obtain a surety bond guaranteeing they will pay all their taxes.

- Utility bond: Guarantees payment of utility bills.

- Contractor license bond: A contractor must purchase this type of bond before receiving their contractor’s license.

- Title bond: Required for registering vehicles or property due to a defective or lost title.

- Lottery bond: Required for any business with a lottery machine.

- Employee theft bond: Protection for companies from potential employee theft.

- Auto dealer bond: Guarantees the public that an auto dealer will abide by the law.

- Alcohol bond: Guarantees that a business will comply with state and federal laws for selling, warehousing, and manufacturing alcohol.

- Business service bond: To protect clients from theft who work with companies with employees who make client home visits.

- License and permit bond: State, federal, and municipal governments may require this bond before granting a professional license to individuals in specific industries.

- Taxable fuel bond: Fuel sellers require fuel tax bonds to guarantee payment of taxes.

- Notary public bond: For protection from losses due to improper notary actions.

You can find all these bonds and more on our website.

What is a contract bond?

A contract surety bond, or construction bond, guarantees that the principal will fulfill their contract. You’ll see these types of bonds most often in the construction industry. A business will often require a contractor to take out a contract bond to ensure they complete the project according to the contract.

A contract bond protects the obligee (the investor in the construction project) from potential financial loss or project disruptions. By purchasing this type of bond, the contractor is ensuring the obligee that they can complete the job according to the project specifications, including but not limited to having the capital to pay for the materials and subcontractors needed to complete the work.

Here are several types of contract bonds available for different projects and situations:

- Bid bond: Assures the project developer that the contractor submitting a bid proposal is serious about the job and has the financial credentials required to accept it.

- Maintenance bond: Protection from defective materials or shoddy work performance.

- Payment bond: Ensures payment for services in case a contractor experiences bankruptcy.

- Performance bond: Requires contractors to complete construction projects according to the contract terms.

- Supply bond: Suppliers commit to providing equipment and supplies ordered by the purchaser.

- Subdivision bond: Guarantees contractors will renovate or build public structures inside subdivisions appropriately.

- Site improvement bond: Guarantees that renovations or enhancements will be completed as promised.

Contract bonds are often required for large federal projects, state projects, and some private projects. As a contractor, you may be required to obtain different bonds at different stages of the construction project.

How to Obtain a Contract or Commercial Surety Bond

To obtain a surety bond, you may need to undergo a background check (providing a credit report and your company’s financial information). Before a surety company issues you a bond, they must ensure your creditworthiness.

Once you’re approved for the bond, you’ll pay a premium – typically ranging from 1% to 15% of the total bond amount – often paid annually. Ensure you obtain your bond from a professional bonding company, preferably one that specializes in surety bonds (versus a general insurance company).

ZipBonds is at your service!

If you need a contract bond, commercial bond, or another type of surety bond, give us a call or fill out a quote request online. We can help you figure out which types of bonds you’ll need when. You can reach us at (888) 435-4191 or support@zipbonds.com.