As a contractor, navigating the world of surety bonds can feel complicated, especially when starting out. Surety bonds play a crucial role in the construction industry, offering financial protection and assurance to all parties involved in a project.

To help you demystify the intricacies of surety bonds, we’ve compiled a comprehensive FAQ guide on construction bonds. We’ll start with the basics and then get more specific on how surety bonds work and why they’re essential to your industry.

1. What is a construction surety bond?

A construction surety bond is a three-party agreement involving the principal (contractor), the obligee (project owner), and the surety company. It guarantees that the contractor will fulfill their contractual obligations. If they fail, the surety company will step in to cover the financial losses.

2. Why do contractors need surety bonds?

Surety bonds instill confidence in project owners and investors. They serve as a financial guarantee that the contractor will complete the project according to the agreed-upon terms and conditions. This assurance makes contractors more attractive to potential clients, presenting opportunities for bidding on larger projects.

3. What are the main types of construction surety bonds?

There are various types of construction surety bonds. The top three are:

- Bid Bonds: Ensure contractors submit serious bids and provide the required performance and payment bonds if awarded the contract.

- Performance Bonds: Guarantee the contractor’s completion of a project per the terms outlined in a contract.

- Payment Bonds: Ensure subcontractors and suppliers will be paid for their work and materials.

4. How do contractors obtain construction surety bonds?

Contractors typically secure construction bonds through surety providers, like ZipBonds. The process involves thoroughly evaluating the contractor’s financial stability, experience, and capacity to complete projects.

Three steps to getting your first construction surety bond:

- Pre-qualify for a bonding program.

- Bid on a job by providing a bid bond.

- Provide a performance and payment bond.

5. What is the underwriting process for a construction bond?

For a surety company to accept the risk of providing a financial guarantee to a contractor, the contractor must undergo an underwriting process. Underwriting determines the risk level of the person or company who needs the construction surety bond.

Here’s a list of the most requested underwriting information:

- Contractor Questionnaire

- Bid specs and contract

- Year-end business financial statements

- Interim business financial statements

- Accounts receivable or accounts payable schedule

- Work-in-progress or work-on-hand schedule

- Personal financial statement

- Bank reference

- Job references

Learn more about these requirements in our guide, “Contractor Underwriting 101.”

6. Can small contractors get surety bonds?

Yes. Surety bonds are not exclusive to large contractors. Many surety providers offer bonding solutions tailored to the needs of small and emerging contractors. Establishing a good relationship with a surety provider can help smaller contractors build their bonding capacity over time.

While it’s true that a strong track record enhances a contractor’s bonding capacity, don’t shy away from applying for the bonds you need if you don’t have this. ZipBonds has many options available for contractors with fiscal or credit restrictions, including:

- Collateral

- Funds control

- Small Business Administration (SBA)

- Co-signers

- A mixture of any of these

Pre-qualify for a contract bond up to $750,000 in two minutes!

7. Do I need construction surety bonds for private jobs?

Many project owners nowadays require surety bonds from contractors, even for private enterprise jobs. Common bonds for smaller jobs include bid, performance, and payment bonds. Bonds can limit risk for private project owners and empower contractors to win larger jobs they may otherwise have no chance of winning.

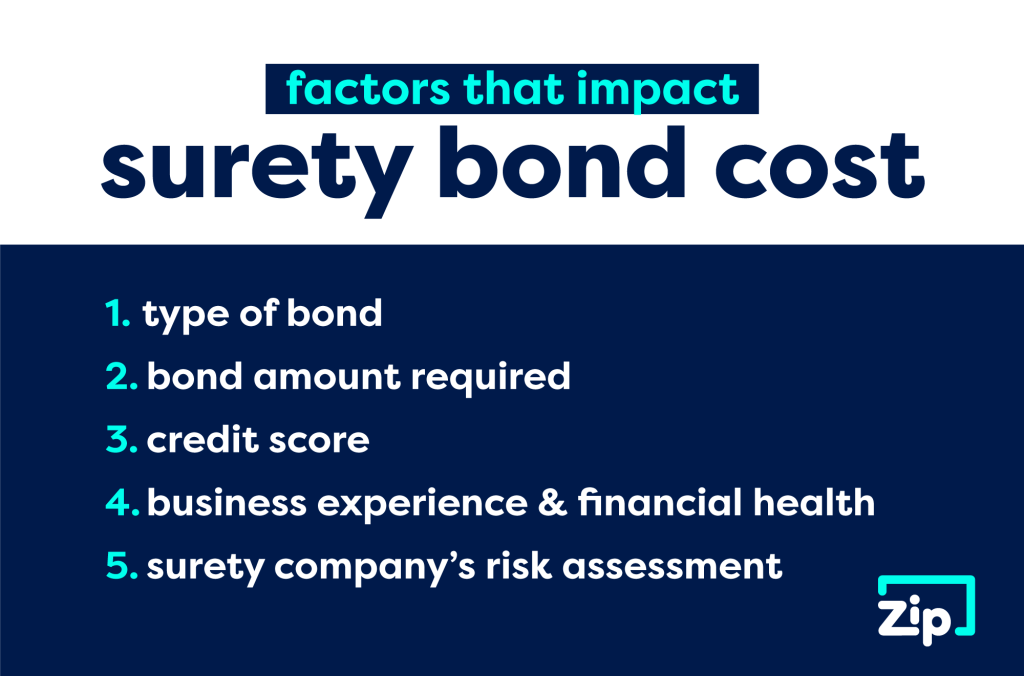

8. What affects the cost of a construction surety bond?

Several factors influence the cost of construction bonds, including the contractor’s financial health, credit history, experience, and project size. Contractors with a solid financial profile typically earn lower bond premiums.

9. How do I know my bond amount?

This is one of the most common questions we get here at ZipBonds. Here’s what you should know:

- Check with who is requiring the bond. What are their requirements?

- Typically, specific bond amounts are mandated by the city, county, or state.

- If part of a contract, your bond amount will typically equal the contract amount.

10. How do I know which bonds I need?

If you’re getting bonded for the first time, we recommend following these tips for the smoothest experience:

- Talk with a surety professional like ZipBonds to alleviate the fear of the process. They can help you understand what types of bonds you need and when you need them.

- Ask your surety partner what information you must provide for your specific bond so the application goes smoothly.

- Don’t hesitate to ask for help with any part of the application or approval process. A good surety provider is just a phone call away!

11. Can contractor surety bonds be canceled?

Surety bonds are typically continuous until canceled by either the contractor or the surety company. In some rare cases, a surety company may cancel the bond if the contractor poses a higher risk or fails to meet their contractual obligations. Contractors should maintain a good relationship with their surety provider to avoid bond cancellations.

12. Are there different bonding requirements for various types of construction projects?

Yes, bonding requirements can vary based on the type and size of the construction project. Larger and more complex projects may have higher bonding requirements and require more information upfront to ensure adequate protection for all parties involved. They may also be more challenging to obtain.

See our guides for more information:

- Contract Bond Underwriting 101: What Do Underwriters Need to Know?

- Surety Bond Qualification for Bid, Performance, and Payment Bonds

13. How long does it take to get approved for a construction bond?

With ZipBonds, the turnaround time from submitting your bond application to receiving your bond is just minutes (when no underwriting is required). If underwriting is required (credit pull, financial evaluation, etc.), we always strive to get your bond to you within 24 hours.

Our website has a unique feature specifically for contract bonds: pre-qualification in two minutes! That means contractors and agents acting on behalf of clients can pre-qualify for various contract bonds up to $750,000. If you need a larger bonding capacity, fill out the form, and we’ll reach out for more information so you can get bonded ASAP.

14. What happens if a contractor faces financial challenges during a project?

If a contractor encounters financial difficulties, it’s essential to communicate promptly with the surety provider. Sometimes, the surety may work with the contractor to find a solution or provide financial support to ensure project completion.

15. How does a contractor’s experience impact their bonding capacity?

Surety providers often consider a contractor’s experience when determining bonding capacity. Those with a proven track record of successfully completing projects are viewed more favorably and may have a higher bonding capacity than those with limited experience. There are many ways to increase your bonding capacity over time, which we’ll cover next.

16. How can contractors improve their bonding capacity?

A greater bonding capacity can help your company grow, allowing you to bid on larger, more complex projects. There are many ways to increase your bonding capacity. Here are seven tips we give our contractors:

- Complete projects on time.

- Pay subcontractors on time.

- Work with the right surety provider who understands your company’s vision and can help you fulfill it.

- Be transparent with your surety company.

- Upgrade your financial presentation by having a third-party CPA prepare your statements using a percentage of completion accounting method.

- Have a strong business plan.

- Be patient.

See our guide for more tips: “What Is Bonding Capacity (for Contractors)?”

17. What happens if a contractor wants to bid on multiple projects simultaneously?

Contractors often bid on multiple projects at the same time. Surety providers will assess contractors’ overall workload and capacity to handle multiple projects. Maintaining a realistic and achievable workload is essential to avoid overextension and potential bonding challenges.

18. Do surety bonds cover design changes or project modifications?

Surety bonds typically focus on the contractor’s performance and financial obligations outlined in the original contract. Design changes or project modifications may require adjustments to the bonding arrangements and typically need to be approved by the surety provider. Contractors should communicate any changes with their surety provider to ensure continued coverage.

19. What is some advice for submitting my first bid?

If you’re submitting your first public bid, carefully read the bid submission requirements. For example, you may need to submit your bid package in a specific envelope! Missing even the smallest details can give a project owner a reason to discard your bid. Remember that everything is important.

20. What are some things I should avoid when bidding public work?

Here are the three main tips we share with contractors when it comes to bidding public projects:

- Only bid a job that requires a performance bond if you have already gone through the process of getting a bond program.

- Only use a cashier’s check for the bid security if you are approved for bonding, or you may lose it!

- Only start a project that requires a performance bond if you have already been approved.

Many private projects now also require bonds to protect the owners. Don’t miss out on the perfect project because you waited too long to get approved. Call us at 888-435-4191 to learn more or get started today.

21. What should I know about funds control?

Funds control is a risk management tool that protects contractors and sureties during bonding. Funds control may be required when the surety has concerns about the contractor’s financial stability, previous performance, or ability to manage project funds responsibly. It’s typically more common for contractors with lower bonding capacity or those facing economic challenges.

Learn more on our blog: “Funds Control in Surety (Quick Guide for Contractors).”

22. Why does my surety provider need my WIP schedule?

A WIP schedule is also essential for a surety’s underwriting. It provides an update on a contractor’s backlog and profitability. A good WIP schedule will show a contractor completing jobs on time and at budget, without severely over- or under-billing, and with a reasonable amount of work based on their given resources.

Failing to track this information carefully can make it difficult for an underwriter to decipher a contractor’s backlog. See our guide, “What Is a WIP Schedule in Construction,” to learn more.

23. Why does my surety provider ask for full financials?

Surety companies scrutinize full financials to evaluate the principal’s financial capacity to complete a bonded project or meet their obligations. By analyzing these documents, they assess several key factors:

- Financial stability

- Liquidity

- Debt and leverage

- Profitability

Read more about full financials and how they play into surety in our guide: “Why Does My Surety Provider Ask for Full Financials?”

24. Do subcontractors need construction bonds?

Several variables determine whether a construction project is successful. One of the most important factors is the subcontractor’s performance. There’s no secret to that statement, which is why we’re seeing the number of subcontractors requiring bonds increase.

The requirement for subs to get bonded is increasing substantially. Even if you’ve never been asked to provide a bond to guarantee your job performance, we highly recommend considering it. The assurance these bonds offer is an extra layer of comfort for anyone doing business with you and can help set you apart from the competition.

In short, if you’re bonded as a subcontractor, there’s a greater chance that your project will succeed.

25. What are the steps to become bonded?

Being bonded means having a surety bond, a financial guarantee that the contractor will fulfill all contractual obligations. This is your safety net as a contractor, guaranteeing you’ll follow through on your promises.

Here are the main steps to getting bonded:

- Determine bond requirements: Understand the type and amount you need.

- Find a surety company: Research and select a reputable surety company.

- Application process: Complete an application and provide financial statements and details about the business.

- Credit check: Undergo a credit check and financial review by the surety company.

- Pay a bond premium: This is typically a small percentage of the total bond amount.

- Obtain the bond: Receive your bond and provide it to the necessary parties.

Learn more in “What Does Licensed and Bonded Mean for a Contractor?”

Surety Bonds for All Your Construction Needs

Understanding surety bonds is essential for contractors aiming to thrive in the competitive construction industry. Surety bonds provide financial security and foster trust, empowering contractors to take on more significant projects and build lasting client relationships.

If you have any other questions or need assistance with a prospective or active construction project, call us at 888-435-4191 or email support@zipbonds.com. We’d love to help you out!