Alcohol Bonds (Federal TTB) for Breweries, Distilleries, and Wineries

What is a federal alcohol bond?

The Alcohol and Tobacco Tax and Trade Bureau (TTB), part of the U.S. Department of Treasury, requires businesses to obtain alcohol bonds as part of the federal licensing process. If you sell, distribute, or manufacture alcoholic beverages, you may be required to purchase some form of alcohol bond. Common federal alcohol bonds include brewer’s bonds, wine bonds, and distilled spirits bonds.

Alcohol bonds are often required for licensure and to ensure you comply with all tax requirements. The TTB is the entity that requires the surety bond and will administer your license.

There are two categories of liquor bonds: state and federal. Throughout this guide, we’ll focus on federal-mandated bonds. We cover what you need to know on the state level in our guide: A Liquor Bond for Your Business.

Get Your Federal Alcohol Bond:

Quick Takeaways

- If you sell, distribute, or manufacture alcoholic beverages, you may be required to purchase some form of alcohol bond.

- By requiring the bond, the government can ensure a business pays any taxes and fees necessary and follows applicable regulations.

- If you have excellent credit, you could pay as little as 1% of the bond amount.

- Common federal alcohol bonds include brewer’s bonds, wine bonds, and distilled spirits bonds.

How do alcohol tax bonds work?

Like other types of surety bonds, alcohol bonds are legal contracts involving three parties:

- Obligee: The U.S. government agency requiring the bond

- Principal: The individual or business that needs the bond

- Surety: The organization that underwrites and backs the bond

By requiring the bond, the government can ensure a business pays taxes and fees and follows applicable regulations. If the business fails to do so, the government may file a claim on the bond to recover its losses. The surety may step in to compensate the government for the lost amount (up to the bond limits). Then the business will need to repay the surety.

Who needs a federal alcohol tax bond?

Any brewery, winery, or distillery that owed at least $50,000 in excise taxes (for alcohol) the previous year will need this federal bond. Your state may also require you to submit a bond for state taxes, regardless of how much you owed in taxes last year.

How much do alcohol bonds cost?

Alcohol bond requirements can vary by state and the type of license you need. The cost will also depend on your credit score. If you have excellent credit, you could pay as little as 1% of the total bond amount.

Wine bonds and distilled spirits bonds are renewed annually. Your bond amounts may change based on how your business performs. Brewer’s bonds run for four years from the effective date and may be continued with something called a “Brewer’s Bond Continuation Certificate.”

Types of Federal Alcohol Tax Bonds

Brewer’s Bond

A bond that guarantees your brewery pays all necessary taxes while operating

Distilled Spirits Bond

A bond that covers the liability for federal excise taxes due on spirits

Wine Bond

A bond that ensures the TTB receives all taxes owed by wine cellars, wineries, and wine warehouse operators

Required Documents for a TTB Permit Application

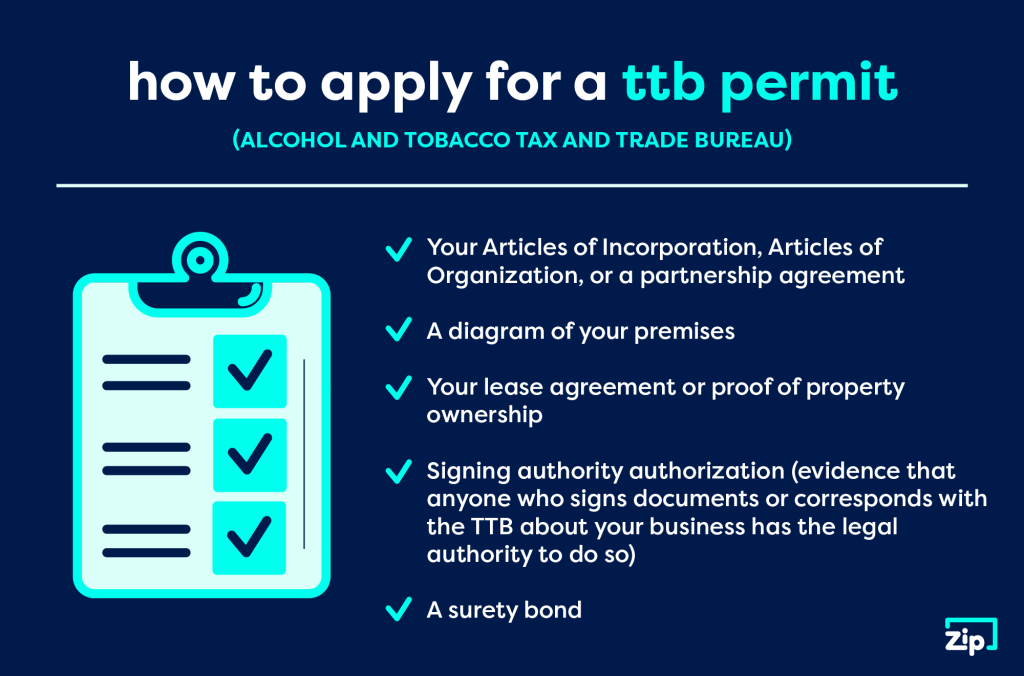

To apply for your TTB permit to operate your distillery, winery, or brewery legally, you will likely need the following documents:

- Your Articles of Incorporation, Articles of Organization, or a partnership agreement

- A diagram of your premises

- Your lease agreement or proof of property ownership

- Signing authority authorization (evidence that anyone who signs documents or corresponds with the TTB about your business has the legal authority to do so)

- A surety bond (if required)

Get the Alcohol Bond You Need to Operate

ZipBonds is the fastest and most secure way to get the federal or state alcohol bond you need. We take out the pain of long, complicated applications. In fact, many of our bonds are approved and processed immediately.

About ZipBonds.com

Founders Ryan Swalve and Zach Mefferd formed the vision for ZipBonds.com when they realized how overly complicated it was to help clients place surety. The frustration of being unable to incorporate the technology they’d used in other insurance-focused projects left them thinking “there has to be a better way.”

Fast forward a couple of years, and that better way is the impetus of everything we do at ZipBonds. We constantly look for innovative ways to improve the bonding process for our clients and agents. Our team comprises individuals who understand all angles of surety – for companies, agencies, and individuals. Incorporating everyone’s point of view to improve the process while simultaneously integrating cutting-edge technology is what sets our business apart.