What is a performance bond?

A performance bond is a type of construction bond that ensures a contractor completes a project as specified in a contract. This surety bond helps guarantee that a construction or real estate development project will be completed successfully – on time and within budget.

The Miller Act requires contractors to place performance bonds on public works contracts equal to or above $100,000. Private sectors using general contractors for company operations may also require performance bonds.

How much does it cost?

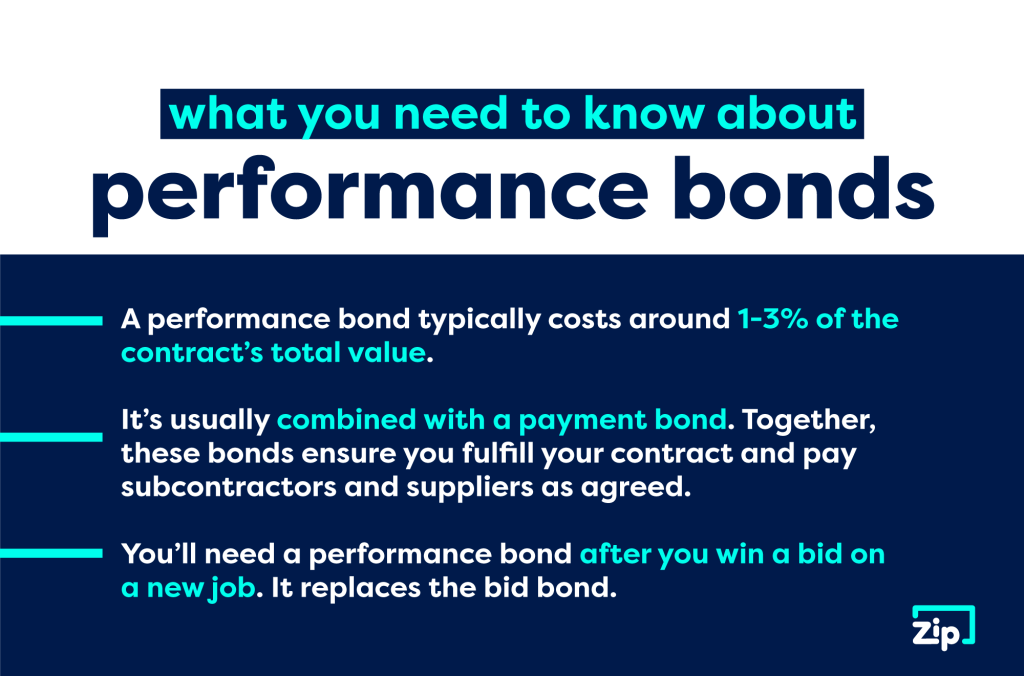

A performance bond is typically around 1-3% of the contract’s total value. However, your credit history, work experience, and financial strength will play into the ultimate cost.

A performance bond is usually combined with a payment bond, which ensures you pay your subcontractors and suppliers as agreed.

Quick Takeaways

- A performance bond is a type of construction bond that ensures a contractor completes a project according to the contract’s terms and conditions.

- After you win a bid on a new construction job, you may need to obtain a performance bond to assure the project owner that you’ll follow through and complete the project as promised.

- A performance bond is typically around 1-3% of the contract’s total value.

How does a performance bond work?

A performance bond involves three parties: the principal who will be doing the work, the obligee who wants the job done correctly, and the surety that provides the bond. After you win a bid on a new job (which requires a bid bond), you may need to obtain a performance bond to reassure the project owner that you’ll follow through and complete the project as promised. This offers the project owner financial and legal security, ensuring that unforeseen circumstances don’t throw a project off-kilter.

Protection for the Obligee

Performance bonds may protect project owners if their contractors are having a difficult time completing a project per the original agreement. If the contractor can’t finish the project, the surety has a variety of ways they can remedy the situation.

When do you need a performance bond?

If you’re a contractor wishing to bid on a government project, you’ll eventually need a performance bond. Many private-sector projects also require surety bonds, depending on the contract terms and the project owner’s preferences. Subcontractors may also need performance bonds. It is an excellent risk mitigation tool for general and prime contractors to use. This ensures their subcontractor will successfully complete their work.

How to Qualify for a Performance Bond

The criteria required to apply for a bid, performance, or payment bond depends on the size of the project. The larger the job, the more information is needed. For projects over $750,000, there will be additional qualifications that will need to be met to secure your bond.

Tips for Project Owners Requiring Performance Bonds

There are pros and cons to performance bonds. As an owner, they can help guarantee that your project is completed according to the terms of your contract. But these bonds also come with a cost.

If these bonds are required, the contractors will put this into their bid number. However, it can sometimes be challenging to prove that a contractor failed to meet the agreed terms. To avoid issues, ensure you comply with all technical conditions of the bond. Also make sure you can quantify the losses you experience if your contractor fails to perform as expected.

What happens when a performance bond is called?

If a contractor isn’t completing a project adequately, the owner may call the bond – also known as making a claim. When the owner calls the bond, they may request payment from the surety provider – up to the value of the bond. The surety will then launch an investigation to determine whether the claim is valid.

If the claim is valid, the surety will handle the situation in one of four ways:

- They will finance the original contractor which enables the original principal to finish the job (and so the obligee recalls the claim).

- The surety can step in as the prime contractor and fulfill the contract terms by selecting proper subcontractors.

- The surety may select a different contractor to finish the project (after the obligee approves).

- The surety could decide to do nothing, leaving the obligee fully responsible for finishing the project independently. In the end, however, the surety must reimburse the owner for additional costs, with a bill up to the total bond amount.

In many cases, the surety will come to a settlement figure with the contractor and obligee to minimize everybody’s liability.

Get a Performance Bond in Your State

Need a performance and payment bond for your next project? Gather essential information like your bid amount, bid date, business history, and credit score, and we’ll do the rest. Select your state below to begin our simple bonding process.

About ZipBonds.com

Founders Ryan Swalve and Zach Mefferd formed the vision for ZipBonds.com when they realized how overly complicated it was to help clients place surety. The frustration of being unable to incorporate the technology they’d used in other insurance-focused projects left them thinking “there has to be a better way.”

Fast forward a couple of years, and that better way is the impetus of everything we do at ZipBonds. We constantly look for innovative ways to improve the bonding process for our clients and agents. Our team comprises individuals who understand all angles of surety – for companies, agencies, and individuals. Incorporating everyone’s point of view to improve the process while simultaneously integrating cutting-edge technology is what sets our business apart.