Payment bonds ensure fair compensation for subcontractors, material suppliers, and laborers involved in large-scale construction projects. This guide delves into the fundamental concepts behind payment bonds, exploring their significance in fostering trust and financial security.

We cover the basics of how payment bonds function, costs involved, how they differ from performance bonds, and other frequently asked questions from new and seasoned contractors.

What are payment bonds?

Payment bonds are a type of contract bond that contractors post to ensure that subcontractors, suppliers, and laborers receive payment on current projects. According to the Miller Act, these bonds are required for federal government projects over $100,000. The “Little Miller Acts,” based on the federal version, also require contractors on state projects to post payment bonds.

Contractors often obtain payment and performance bonds simultaneously (on the same bond form) and use them in conjunction.

Quick Takeaways

- A payment bond is a contract bond that contractors post, guaranteeing pay to suppliers, laborers, and subcontractors on a project.

- It ensures payments comply with federal and state laws.

- They typically cost about 1-3% of the contract amount for applicants with strong financial backing and work history.

How do payment bonds work for construction projects?

Contractors (or subcontractors) typically obtain payment bonds at the start of a new construction project. These bonds protect those supplying labor and materials for a project by ensuring proper and timely payment. They also guarantee that payments comply with federal and state laws.

Construction payment bonds, like other surety bonds, involve three parties:

- An obligee who requires the bond (e.g., project owner)

- The principal (contractor)

- A surety company (bond underwriter)

If a contractor fails to pay a supplier or subcontractor, they can file a claim on the bond. The surety company will investigate the situation to determine if the claim is valid and what action they should take to remedy the issue. If the claim is valid, the supplier and subcontractors may receive compensation up to the value of the payment bond. The principal will then repay the surety. These bonds protect the obligee so that liens aren’t filed on the project owner’s property.

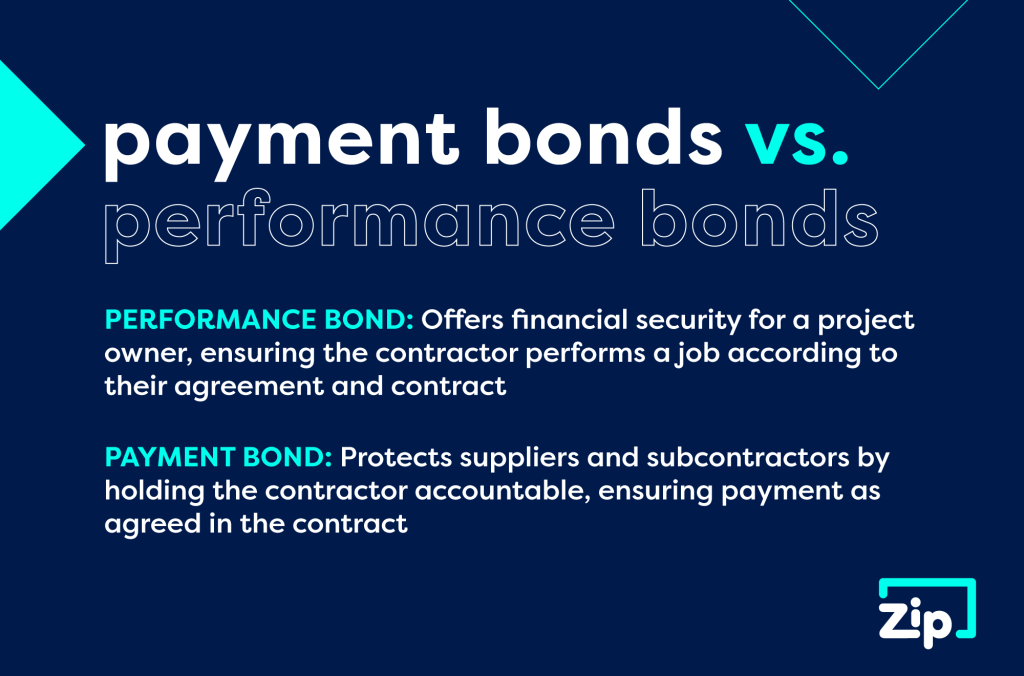

Payment Bonds vs. Performance Bonds

Since payment and performance bonds are closely related, we want to clarify any possible confusion. While often issued simultaneously – after a contractor wins a bid – each bond has a distinct purpose.

- A performance bond offers financial security for a project owner, ensuring their contractor performs a job according to their agreement and contract.

- A payment bond protects suppliers and subcontractors by holding the contractor accountable, ensuring they pay them as agreed in the contract. In a roundabout way, this also protects the project owner, ensuring no liens are filed.

How do I know if I need this bond?

Check the specifications and contract documents to determine if you need a payment bond for your construction project.

- Public projects (over $100,000), especially those funded by the government, often require payment bonds.

- More extensive projects or higher contract values may also necessitate payment bonds.

- Private projects may include bonding requirements in their contracts as well.

- Lenders or project owners might mandate payment bonds for added protection.

In short, if you’re a general contractor, you will likely need a payment bond (and a performance bond) to replace your bid bond after you win a job.

State and local regulations, industry standards, and a careful risk assessment can help you decide whether obtaining a payment bond is necessary for your specific project. If uncertain, seek guidance from legal professionals or construction industry experts.

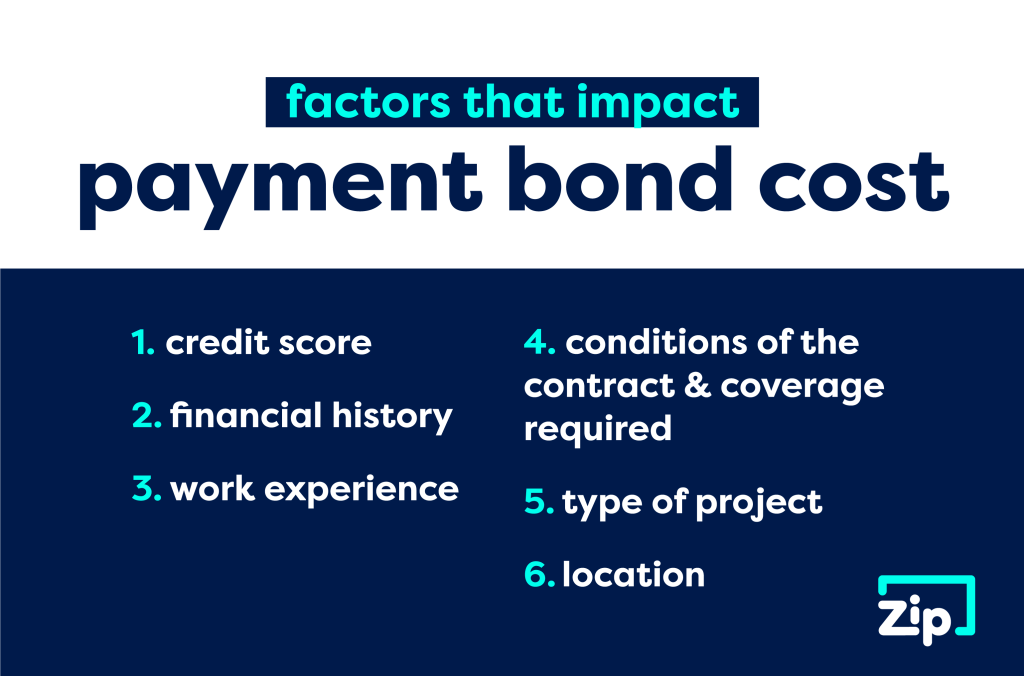

How much does a payment bond cost?

Payment bonds typically cost 1-3% of construction contracts for contractors with strong financial backing and work history. If a performance and payment bond are issued on the same project, you do not have any additional cost for a payment bond. This percentage is your “surety bond premium.” The total bond amount is called a penal sum – the amount of coverage required by law for a project.

For example, if you need a $100,000 bond and pay 3%, your bond would cost $3,000. However, if someone files a claim against your bond, you could be liable for the entire bond amount. This is why bonding is essential. It encourages contractors to remain in good legal standing and abide by contract terms.

Factors that Influence Bond Cost

- Creditworthiness

- Financial history

- Work experience

- Conditions of the contract and coverage required

- Type of project

- Location

Do you need payment bonds for private construction projects?

Many private project owners require contractors to get bonded before bidding or taking on a job. This offers protection for the owner if something goes wrong, such as the contractor reneging on the contract or damaging property midway through the project. It also covers issues we’ve been facing since the pandemic hit, like supply chain holdups and material cost increases.

Types of bonds you may need for private construction jobs include: bid bonds, performance bonds, payment bonds, supply bonds, and maintenance bonds.

Learn more about contract bonds for private construction projects on our blog.

Frequently Asked Questions

In addition to payment bonds, contractors usually need:

- Contractor license bonds (you’ll likely need this bond before you can get a license or permit to work in your state or city)

- Bid bonds (if a project requires you to participate in the bidding process)

- Performance bonds (purchased alongside payment bonds after winning jobs)

You may also need maintenance, supply, and other construction bonds throughout a project.

“Are contractors with bad credit bondable?” Obtaining the bonds you need can be more challenging if you have poor credit, but it may not be impossible. Some companies may turn you down, while others might offer you a bond if you pay a higher premium.

Other agencies, like ZipBonds, can help connect you with affordable bonds. We have a vast network of sureties and can impartially shop to find you a great match – a company that provides excellent coverage at a fair rate.

Claims are used in construction projects to ensure subcontractors, suppliers, and laborers receive payment for their work and materials. Before a construction project begins, a contractor must get a payment bond from a surety company. If the general contractor fails to fulfill payment obligations, parties seeking payment can issue a notice of non-payment and, if necessary, file a formal payment bond claim.

The surety company then investigates the claim and, if deemed valid, pays to cover the outstanding amount owed. Legal action may be pursued if disputes arise. Compliance with local laws and bond terms, including notice requirements, is crucial in navigating claims successfully.

How to Get a Performance & Payment Bond in Your State

Need a performance and payment bond for your next project? Gather essential information like your bid amount, bid date, business history, and credit score, and we’ll do the rest. Select your state below to begin our simple bonding process.

About ZipBonds.com

Founders Ryan Swalve and Zach Mefferd formed the vision for ZipBonds.com when they realized how overly complicated it was to help clients place surety. The frustration of being unable to incorporate the technology they’d used in other insurance-focused projects left them thinking “there has to be a better way.”

Fast forward a couple of years, and that better way is the impetus of everything we do at ZipBonds. We constantly look for innovative ways to improve the bonding process for our clients and agents. Our team comprises individuals who understand all angles of surety – for companies, agencies, and individuals. Incorporating everyone’s point of view to improve the process while simultaneously integrating cutting-edge technology is what sets our business apart.