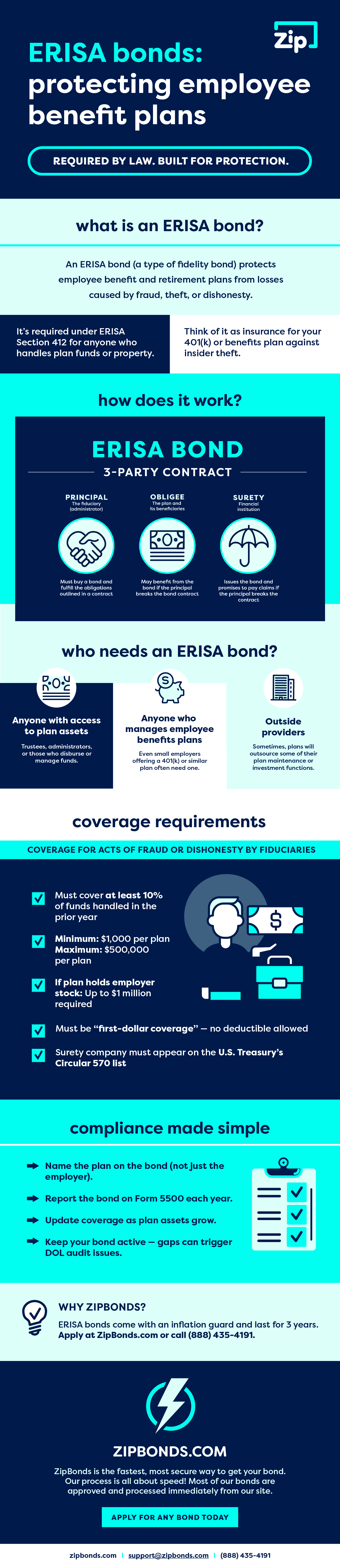

What Is an ERISA Bond?

An ERISA bond (also called an ERISA fidelity bond) protects employee benefit and retirement plans from losses caused by fraud, theft, or dishonesty.

It’s required under ERISA Section 412 for anyone who handles plan funds or property.

Think of it as insurance for your 401(k) or benefits plan against insider theft.

Who Needs One?

Anyone with access to plan assets — like trustees, administrators, or those who disburse or manage funds.

Exemptions: Banks, registered broker-dealers, and church plans.

Even small employers offering a 401(k) or similar plan often need one.

Coverage Requirements

- Must cover at least 10% of funds handled in the prior year

- Minimum: $1,000 Maximum: $500,000 per plan

- If plan holds employer stock: Up to $1 million required

- Must be “first-dollar coverage” — no deductible allowed

- The surety company must appear on the U.S. Treasury’s Circular 570 list

What’s Covered (and What’s Not)

Covers: Fraud, theft, embezzlement, forgery, and misappropriation

Doesn’t cover: Bad investment decisions, negligence, or administrative errors

Fiduciary liability insurance protects against those — but doesn’t replace an ERISA bond.

Compliance Made Simple

- Name the plan on the bond (not just the employer)

- Report the bond on Form 5500 each year

- Update coverage as plan assets grow

- Keep your bond active — gaps can trigger DOL audit issues

Get Bonded Fast with ZipBonds

ZipBonds helps small businesses and plan administrators secure ERISA bonds in minutes — online, nationwide, and fully compliant. Apply at ZipBonds.com or call (888) 435-4191.

No hidden fees. No confusion. Just fast, compliant bonding.

Apply for an ERISA bond today!