Securing a surety bond is a crucial step for many business owners and contractors. Whether you’re new to surety bonds or looking to dive deeper, this guide will provide valuable insights. Learn how bond premiums are calculated, the risk factors, and how you can earn better rates.

What are surety bond rates?

Let’s start with the basics. Surety bond rates are essentially the premiums you pay for surety bonds. The premium is a percentage of the total bond amount. It compensates the surety company for the risk of taking on your bond.

How are surety bond rates calculated?

Next, let’s cover how bond rates are calculated so you know the factors that impact your bond cost. Surety bond rates boil down to three main factors: your reputation, ability to get the job done, and financial stability.

1. Reputation

Your personal and professional reputation and your history of fulfilling contractual obligations contribute to your character assessment. Sureties assess your trustworthiness and track record.

2. Deliverability

Can you deliver on what you promise? Your experience, skills, and resources all play into this. If you have a solid history of completing projects on time and within budget (including your ability to meet the obligations outlined in a bond), you’re seen as less risky and will likely snag a much better rate.

3. Stability

Sureties want to know you have the resources to cover any potential losses. If your business has a strong financial track record and healthy bank accounts, you’re likelier to score a lower surety bond rate. Your capital, assets, and liabilities all impact your “bondworthiness.” A high personal credit score can also significantly affect your surety rates.

What are typical surety bond rates?

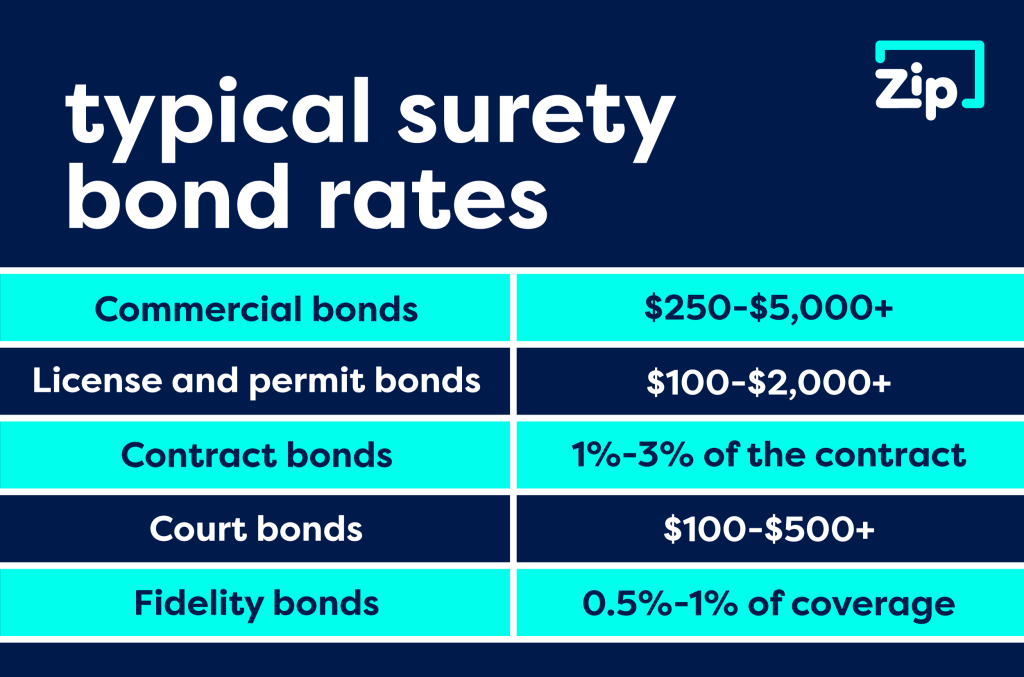

The cost of a surety bond can vary widely depending on the type of bond and the applicant’s risk level. Generally, rates range from 0.5% to 10% of the total bond amount. For example, a $50,000 bond could cost anywhere from $250 to $5,000 annually.

How does a bond’s risk level affect my rates?

The risk level of the bond also directly impacts your rates. Higher-risk bonds, such as those associated with larger projects or industries prone to claims, may have higher rates. Conversely, lower-risk bonds, like many license and permit bonds, may have much lower rates.

What if I have bad credit?

A lower credit score doesn’t necessarily mean you can’t secure a surety bond. While bad credit may result in higher rates, some bonding companies specialize in working with applicants with credit challenges.

Check out our guide called “Can I Get a Surety Bond with Bad Credit?” where we address the most common concerns and questions on this topic and explain how our Bad Credit Surty Bond Program works.

How are bonds issued?

Bond providers issue surety bonds in a few different ways:

- Instantly (no credit pull): Certain bonds, particularly those with lower risk, may be issued instantly without requiring a credit check. Title, notary, and many contractor license bonds are issued this way.

- Express: Express bonding involves a streamlined process for faster approvals, making it ideal for time-sensitive projects. For example, ZipBonds has a Quick Start program for contractors seeking construction bonds. We can pre-qualify many contractors in just 3 minutes!

- Quote: A quote-based approach allows bonding companies to assess the risk and provide a customized rate for more complex bonds.

How to Earn the Lowest Surety Bond Rates

Securing favorable surety bond rates involves proactive measures on your part. You can work to strengthen your surety bond applications in three key areas.

1. Personal Credit Report

Maintain a healthy credit score by managing your debts responsibly and addressing any outstanding issues. Make sure your personal credit report is accurate and up to date. Dispute any errors and work to improve your credit score as much as possible.

2. Experience

Highlight your industry experience and successful project completion history to showcase your reliability. Provide references from satisfied customers or clients.

3. Financial Strength

If you’re a business owner, ensure your financial statements are accurate and show a strong balance sheet and healthy cash flow. Consider getting audited financial statements to help improve your application.

Understanding the factors that play into surety bond rates is essential for contractors, insurance agents, business owners, and license applicants. By improving your application and addressing any areas of concern, you can help lower your rates and obtain the coverage you need!

Score the Best Surety Bond Rates for Your Business

ZipBonds is the fastest, most secure way to get the bonds you need. Our all-digital platform removes the pain of filling out long, complicated applications and waiting hours or days to hear back from someone. Apply online or contact us by calling (888) 435-4191 or emailing support@zipbonds.com.