What does it mean to be bonded? You may have asked this question yourself. Or maybe you’ve hired another party that advertised their business as being “licensed, bonded, and insured.” Being bonded can provide a level of assurance and protection for your customers. But what exactly is the meaning behind behind bonded?

The concept can feel confusing, so we’re designating an entire article on the topic. By the end of this guide, you’ll understand what being bonded means, the difference between being bonded and insured, the most popular types of surety bonds, and the costs associated with the bonding process. Let’s dive in.

What does it mean to be bonded?

Bonded Meaning

Being bonded means that a business or service provider has purchased a surety bond, which is a contract between three parties:

- The principal (the business or service provider)

- An obligee (the customer or entity requiring the bond)

- A surety (the company that provides and backs the bond in case of claims)

A surety bond is a form of protection for the obligee in case the principal fails to fulfill their obligations or commitments as outlined in a contract.

Surety Bond Meaning

We define surety bonds in depth in a previous article: “What Is a Surety Bond?” We’ll touch on it briefly here.

A surety bond is a legally binding contract that guarantees the performance of a specific obligation. If the principal in the agreement fails to fulfill their duties, the surety will pay damages to the obligee up to the bond’s limit. Remember that a surety bond is not insurance for the principal but rather a form of protection for the obligee.

What is the difference between being bonded and insured?

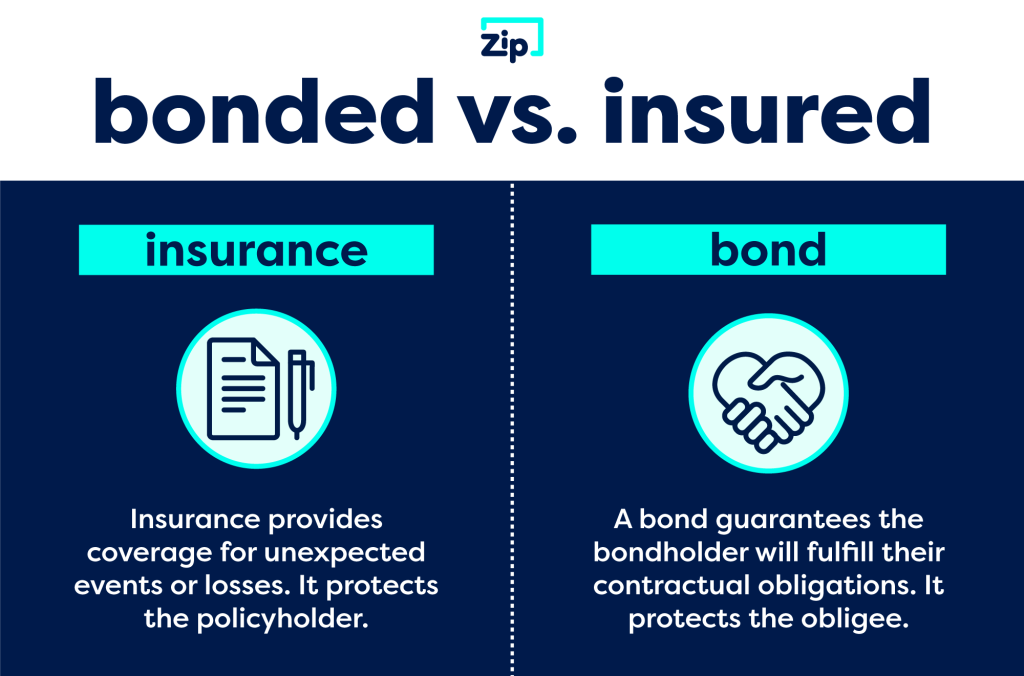

While bonded and insured (through surety bonds and insurance) are both forms of protection, they play very different parts.

- Insurance provides coverage for unexpected events or losses. They protect the policyholder.

- Bonds provide assurance that the bondholder will fulfill their contractual obligations. A bond protects the obligee (the party that requests the bond) and the bondholder’s clients/customers (if applicable).

Being bonded does not replace the need for insurance. Many businesses and service providers should have both a surety bond and insurance.

Bonded and Insured Meaning

To make these concepts crystal clear, here’s another way to put it:

- When a business or service provider is bonded and insured, they have 1) purchased a surety bond and 2) obtained insurance coverage.

- Being bonded and insured protects the business or service provider and their customers.

What are the main types of bonds?

There are several types of bonds, but the most common bond categories include:

- License and permit bonds: Required by state or local governments to ensure that businesses comply with regulations while performing work in the area

- Contract bonds (construction bonds): Ensure contractors fulfill their obligations under a specific contract

- Court bonds: Required in legal proceedings to guarantee that a party will fulfill their legal obligations

- Fidelity bonds: Protect employers from damages associated with losses their employees cause

Who should get bonded?

1. Contractors

Many businesses and government agencies require their contractors to be bonded. This is because bonds help to protect them from financial losses if the contractor fails to fulfill their contractual obligations.

2. Businesses & Service Providers

Businesses and service providers that work in fields where they must be licensed, registered, or certified by a government agency may also need a surety bond. Examples include:

- Auto dealers

- Freight brokers

- Breweries, wineries, liquor stores

- Marijuana dispensaries, labs, cultivation and processing facilities

- Cleaning companies

3. Companies Handling Large Sums of Money or Providing High-Risk Services

Additionally, businesses that handle large amounts of money or provide services requiring a high level of trust may benefit from being bonded. Examples include:

- Financial institutions

- Insurance companies

- Money transmitters

- Stock brokerage firms

How much does it cost to get bonded?

The cost of obtaining a surety bond varies depending on the type of bond, the amount of coverage required, and the financial strength of the principal. Generally, the cost is a percentage of the total bond amount, ranging from 1-15% for most bonds.

Other Surety Bond Resources

There are various resources available to help you learn more about surety bonds. Some of our top recommendations include the following:

- Surety & Fidelity Association of America: A trade association that represents surety companies through advocacy, education, promotion, and outreach

- U.S. Department of Treasury: Provides information on surety bonds on its website

- National Association of Surety Bond Producers: A trade association that provides information and resources for businesses and service providers looking to obtain surety bonds

Of course, if you have any questions or need any surety bonds, you can contact ZipBonds online (email us!) or over the phone by calling (888) 435-4191. Our agents are ready and happy to help you find whatever you’re looking for.

Get the Surety Bonds You Need Fast

Surety bonds can help you establish trust with your customers and comply with government laws and regulations. At Zip, we make getting bonded as easy and fast as possible. If you have any questions, give us a call at (888) 435-4191.