How to Get a Bonded Title Texas in 5 Steps

What is a Texas title bond?

A Texas title bond is a surety bond for Texas residents without a certificate of title to their vehicles. If you fall into this boat, you may need to purchase a title bond to register and insure your car. Suppose you have incorrect or insufficient evidence of vehicle ownership and can’t contact the previous owner for the documentation you need. In that case, you may need to apply for a bonded title in Texas to claim ownership of your vehicle.

What is a bonded title in Texas?

A bonded title in Texas is a certificate of title with a bond attached. In short, it proves that you own your vehicle. It also protects past and future owners, lienholders, and anyone else with a security interest in your car if they suffer damages due to you claiming ownership. When you post your title bond, you’re promising you’re the legitimate owner and agree to take responsibility if other parties suffer losses.

Get Your Texas Title Bond:

Quick Takeaways

- A Texas title bond is a surety bond for Texas residents without a certificate of title to their vehicle.

- A bonded title proves that you own your vehicle.

- To qualify for a Texas bonded title, you must be either a state resident or military personnel stationed in the state.

- Title bonds are quickly issued, typically cost around $100, and have a 3-year bond period.

Who needs a bonded title in Texas?

If you can’t prove that you own your vehicle, you may need a bonded title. Here are specific instances that may require you to apply for a bonded title in Texas:

- You never received a title when you bought or received your car.

- Your title was improperly assigned to you. or

- You lost your title before transferring it to your name.

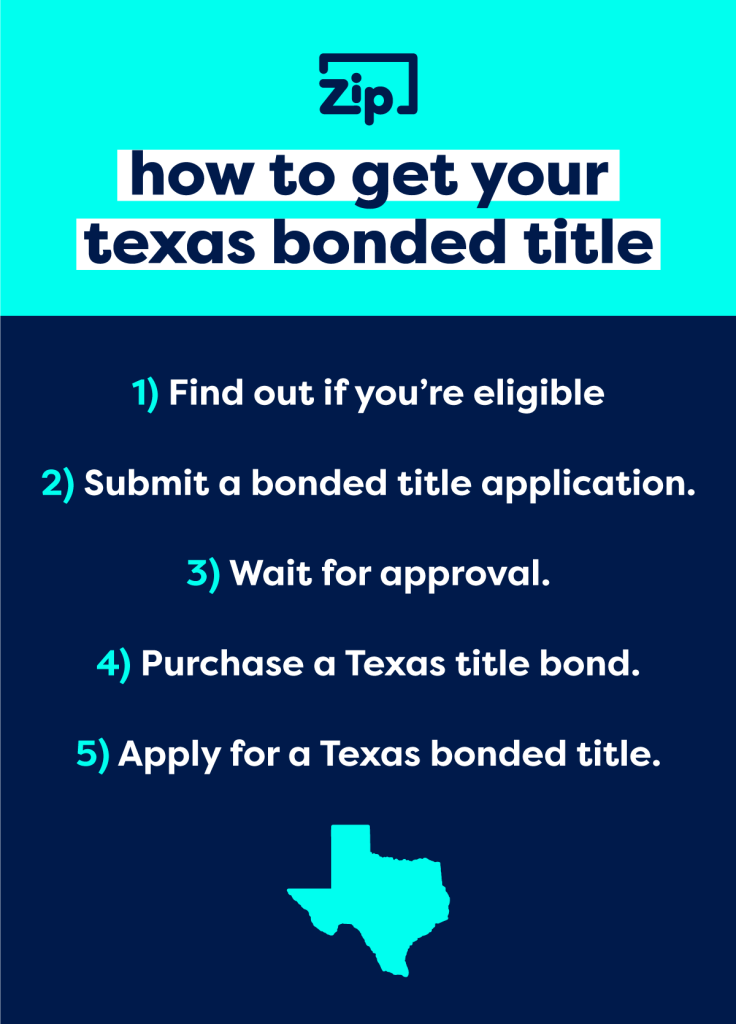

How to Get Your Bonded Title in Texas

1. Find out if you’re eligible for a bonded title.

To qualify for a Texas bonded title, you must be either a Texas resident or military personnel stationed in the state. You must also legally possess the vehicle. If it’s considered nonrepairable, junked, or ineligible for a title for another reason, you won’t qualify. Your vehicle must be complete – with a body, motor, and frame. Contact the Texas DMV to ensure you’re eligible before applying.

2. Submit your bonded title application.

If you meet the requirements for a bonded title, proceed by compiling and submitting the following documents to your nearest TxDMV Regional Service Center.

- Supporting evidence of ownership (invoice, bill of sale, canceled check, etc.)

- Photo ID

- Bonded title application

- $15 processing fee (cash, check, or money order)

3. Wait until your application is approved.

If your application is approved, you will receive a Notice of Determination for a Bonded Title or Tax Assessor-Collector Hearing. This form will tell you what bond to purchase in the next step.

4. Purchase a Texas title bond.

Your bond must be equal to 1.5 times your vehicle’s value. You can get a three-year bond from a direct surety provider like ZipBonds for as little as $100. Keep in mind you will only have one year to purchase your bond before your application expires. Purchase a Texas title bond.

5. Apply for your Texas bonded title.

Finally, you can complete the Application for Texas Title and/or Registration. Just make sure you do so within 30 days of purchasing your bond. Take your original Notice of Determination that you received from the Regional Service Center (along with all documents listed in Step 2) to your county tax office. Once your application is received and approved, you’ll be issued a bonded title!

What if I have an out-of-state vehicle?

If you’re a state resident but your vehicle is from out of state, a Texas-certified Safety Inspection Station must verify your VIN before your application can be approved. If your vehicle has never had a title or registration in Texas, you may also need a VIN inspection from an auto theft investigator. Contact your local law enforcement agency for more information on where to get an inspection.

How do Texas title bonds work?

A Texas title bond must remain in effect for three years from the date of issuance. When the bond expires, the bond will be returned to the owner (unless someone has filed a claim against it). If someone files a claim and says you owe them money, your surety will investigate to determine if the claim is legitimate. If it is, you must reimburse the claimant for their loss.

How much do Texas title bonds cost?

Texas title bonds are quickly issued, typically cost around $100, and have a 3-year bond period. After the bond expires, there is no requirement for the bond. You will be eligible for a standard certificate of title.

People Also Ask:

No. If you can get the lien released, then you can obtain a bonded title.

A bonded title is a car title backed by a surety bond to ensure that any potential claims that arise are covered. If you have the bonded title for three years and haven’t faced any bond claims (from previous owners or lienholders), you can apply for a clean title.

Your bonded title must remain in effect for three years then the DMV can issue you a traditional car title.

After the three-year bonded title period, you can apply for a traditional certificate of title in Texas for your vehicle.

Yes, you can! If your title is bonded, you can still sell your car to a new owner. You can also register, insure, and prove you legally own it.

Get Your Title Bond in Texas

The experts at ZipBonds can help you get the bond you need. You can connect with one of our team members by calling 888-435-4191 or emailing support@zipbonds.com. We’re happy to walk you through the process for title bonds to help you get bonded in a flash.

About ZipBonds.com

Founders Ryan Swalve and Zach Mefferd formed the vision for ZipBonds.com when they realized how overly complicated it was to help clients place surety. The frustration of being unable to incorporate the technology they’d used in other insurance-focused projects left them thinking “there has to be a better way.”

Fast forward a couple of years, and that better way is the impetus of everything we do at ZipBonds. We constantly look for innovative ways to improve the bonding process for our clients and agents. Our team comprises individuals who understand all angles of surety – for companies, agencies, and individuals. Incorporating everyone’s point of view to improve the process while simultaneously integrating cutting-edge technology is what sets our business apart.