Mixed Beverage Bond

Do you or your clients sell mixed beverages in Texas? If so, you may need a mixed beverage sales tax bond and a mixed beverage gross receipts bond. These bonds are required in addition to conduct (TABC) bonds. Read on to learn more.

What is a Texas mixed beverage bond?

Those wishing to sell or serve alcoholic beverages in Texas must purchase mixed beverage bonds and renew them annually. These bonds ensure permit holders pay sales taxes on time or pay penalties if they miss deadlines.

Get Your Mixed Beverage Bond:

Quick Takeaways

- Those wishing to sell or serve alcoholic beverages in Texas must purchase mixed beverage bonds and renew them annually.

- These bonds ensure permit holders pay sales taxes on time or pay penalties if they miss deadlines.

- Mixed beverages include any alcoholic beverage, including beer, ale, wine, or distilled spirits, sold or served on the permit holder’s property.

- Premiums start as low as $100 per year.

- Bonds expire on December 31 each year and must be renewed to avoid lapses in coverage.

Types of Mixed Beverage Bonds in Texas

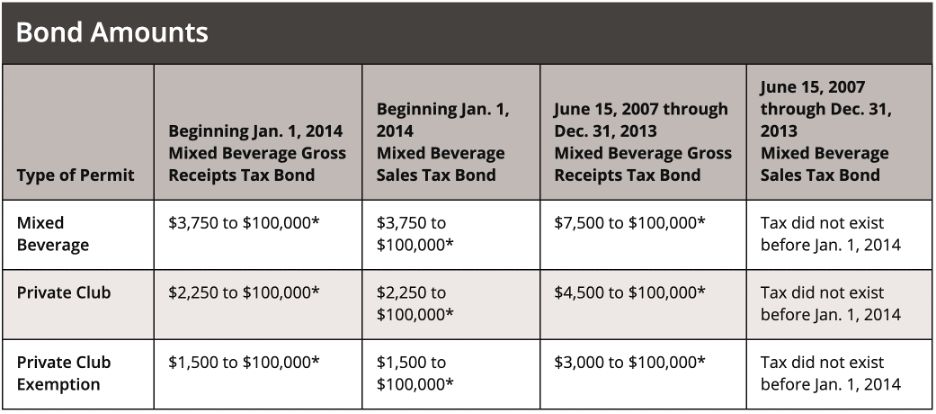

Both mixed beverage and private club permit holders must post a mixed beverage gross receipts bond and a mixed beverage sales tax bond.

A mixed beverage in Texas includes any alcoholic beverage, including beer, ale, wine, and distilled spirits, that is sold or served to be consumed on a permit holder’s property. To be considered alcoholic, a beverage must contain more than 0.5-1% alcohol by volume.

1. Mixed Beverage Gross Receipts Tax Bond

This bond ensures permittees pay the required 6.7% mixed beverage gross receipts tax. The bond amount required can range from $3,750 to $100,000, based on what the Texas Comptroller requires of your business. To estimate your bond amount, use the following formula:

- Your bond amount = 4 x your average monthly tax liability over 12 months ($100,000 maximum)

Mixed Beverage Gross Receipts Tax Bond Application

2. Mixed Beverage Sales Tax Bond

This bond ensures permittees pay the required 8.25% mixed beverage sales tax (which you should be charging your customers on sales). The bond amount required can range from $3,750 to $100,000.

Source: Comptroller.Texas.Gov

How much do mixed beverage bonds cost?

The premium on these bonds starts as low as $100 per year. This bond expires on December 31 each year and must be renewed to avoid a lapse in coverage. ZipBonds will reach out a few months before the deadline to ensure you renew in time.

Frequently Asked Questions

If you have or are applying for any of the following permits, you will need to pay taxes on mixed beverages:

- Mixed beverage permit

- Distiller’s or rectifier’s permit

- Private club registration permit

- Private club exemption certificate permit

- Caterer’s permit

- Daily temporary mixed beverage or private club permit

- Mixed beverage or private club late hours permit

- Mixed beverage or private club registration permit holding a food and beverage certificate

If you have a low credit score, you may still be able to get bonded. Our Bad Credit Program allows applicants to get the bonds they need at affordable rates, typically 10-15% of the bond amount. Call us at 888-435-4191 to learn more.

How to Get Your Texas Mixed Beverage Surety Bond

ZipBonds offers the fastest and most secure option for getting the surety bonds you need. Our all-digital platform is intuitive and straightforward. Click on the application links below to receive a quote in minutes. If you have any questions, feel free to contact support@zipbonds.com or call (888) 435-4191 to speak with an agent.

About ZipBonds.com

Founders Ryan Swalve and Zach Mefferd formed the vision for ZipBonds.com when they realized how overly complicated it was to help clients place surety. The frustration of being unable to incorporate the technology they’d used in other insurance-focused projects left them thinking “there has to be a better way.”

Fast forward a couple of years, and that better way is the impetus of everything we do at ZipBonds. We constantly look for innovative ways to improve the bonding process for our clients and agents. Our team comprises individuals who understand all angles of surety – for companies, agencies, and individuals. Incorporating everyone’s point of view to improve the process while simultaneously integrating cutting-edge technology is what sets our business apart.