Freight Broker Surety Bonds

What is a freight broker surety bond?

The Federal Motor Carrier Safety Administration (FMCSA) requires U.S.-based transportation brokers to obtain a freight broker surety bond (or a trust fund agreement) as part of the licensing process. You must file this license and permit bond before receiving a license to operate as a freight broker or freight forwarder. The bond protects motor carriers that brokers hire to complete jobs for them, ensuring brokers compensate them fairly and honestly.

These are sometimes called ICC broker bonds, BMC-84 bonds, transportation broker bonds, or property broker bonds. If you want to learn about surety bonds for ocean transportation businesses, read our guide on Federal Maritime Commission OTI Bonds.

What is the FMCSA?

The Federal Motor Carrier Safety Administration is the leading federal agency tasked with regulating and providing safety oversight of commercial vehicles. Its mission is to reduce injuries, crashes, and fatalities that involve buses and large trucks.

Quick Takeaways

- The FMCSA requires U.S.-based transportation brokers to obtain a freight broker surety bond (or a trust fund agreement) as part of the licensing process.

- BMC-84 is the form you will file to obtain your freight broker bond. You may choose the trust fund option by filing Form BMC-85.

- To obtain a BMC-84 bond, you must pay a premium equal to a small percentage of the $75,000 bond.

BMC-84 Surety Bonds vs. BMC-85 Trust Funds

Freight brokers have the option of filing a surety bond or obtaining a trust fund. BMC-84 is the form you will file to get your freight broker bond. You may choose the trust fund option by filing Form BMC-85. Whichever option you choose, you will need $75,000 worth of coverage.

The trust fund requires $75,000 worth of collateral, so it is generally only used when a surety bond cannot be obtained. A surety bond requires an annual premium – a small percentage of the total bond value. Thus, it is the preferred option for most companies.

Who needs a freight broker bond?

If you want to obtain a property broker license from the FMCSA, you will need this bond. It’s required to operate legally in the U.S. The bond requirement ensures freight brokers and freight forwarders abide by industry standards and helps prevent fraud and failure to pay motor carriers as promised.

How much do freight broker bonds cost?

To obtain a BMC-84 bond, you must pay a premium equal to a small percentage of the $75,000 bond. The exact rate may depend on various factors, including your credit score, industry experience, and business and personal financial information. As a ballpark estimate, you might pay anywhere from 1-12% (or $750-$9,000).

Freight broker bonds are valid for one year and then must be renewed. Either freight brokers or the FMCSA may cancel the bond by giving a 30-day notice.

ZipBonds offers these bonds for as low as $938. We also have solutions for ALL credit levels. Call us today at 888-435-4191 or apply for this bond online!

How does a freight broker bond work?

This surety bond is a contract between three parties:

- Obligee: The U.S. government that requires the bond

- Principal: The freight broker that needs the bond

- Surety: The company that issues the bond and guarantees payment if there’s a claim

The bond ensures that the freight broker or forwarder will uphold industry standards, laws, and regulations. It protects motor carriers and shippers from fraud and unfair or untimely payment. If the principal fails to follow the bond agreement terms, a motor carrier (or another party who suffers damages) may file a claim against the bond. These bonds help hold brokers accountable and eliminate some of the risks involved in hauling freight. They can also enhance the freight broker industry’s reputation by raising standards and building trust with haulers.

What happens if someone files a claim?

If someone files a valid claim against your bond, the surety may settle it for you by paying the claimant up to the total bond amount. You (the principal) must then repay the surety for covering for you. If someone files a false claim, you might want to fight it. The best way to avoid paying for a false claim is to understand what your bond covers and what it doesn’t. That way, you can be sure to follow all FMCSA regulations and pay motor carriers as needed.

Freight Broker Surety Bond Requirements

Here’s an overview of what you may need to provide when applying for your surety bond with a bond company:

- MC number

- Business name

- Contact information

- Years in business

- Residency status

- Ownership

- Active claims (if applicable)

Your bond will be valid for one year from the date of issue. Renew your bond annually to maintain an active business license. If you’re ready to retire or shut down your business, you must give the FMCSA 30 days’ advanced notice. Use Form BMC-36: Notice of Cancellation.

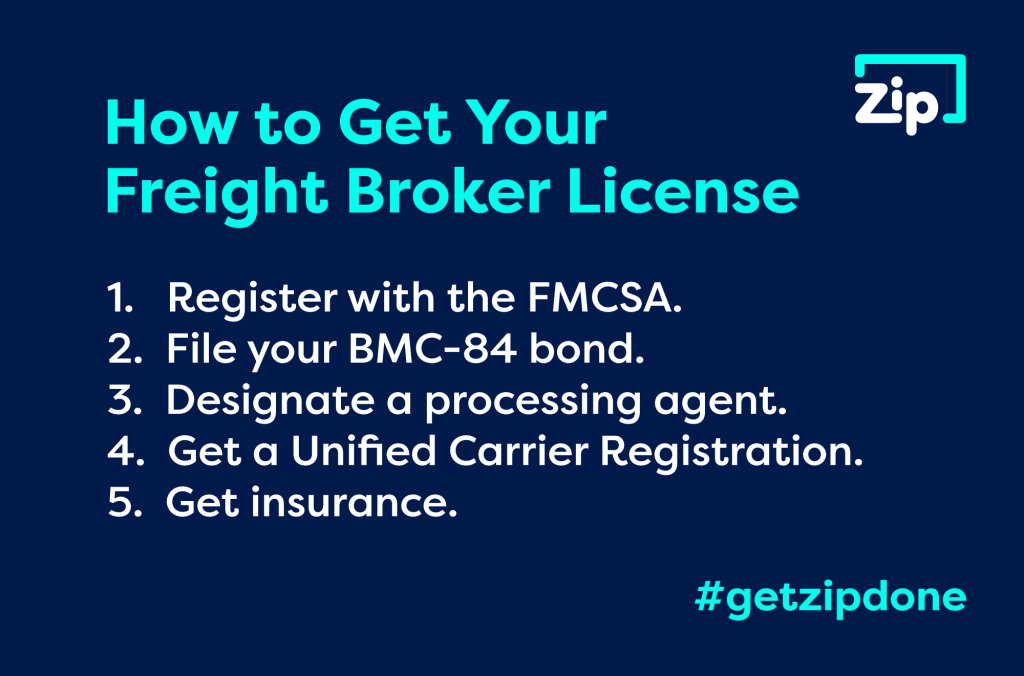

How to Get Your Freight Broker License

As a freight broker or freight forwarder, you must register with the FMCSA before beginning operations or facilitating the transportation of goods. You’ll follow this general process to obtain your freight broker surety bond and license. Note that you must have either three years of industry experience or evidence of industry knowledge for license approval.

- If you’re a new freight broker, you will need to register with the FMCSA to obtain broker authority and get your motor carrier (MC) number. Submit Form OP-1 (Application for Motor Property Carrier and Broker Authority) and pay the $300 fee.

- File your BMC-84 bond or BMC-85 trust fund in the amount of $75,000. You can apply for your surety bond on the ZipBonds website, and we’ll find you the best rates available then issue your bond quickly and securely.

- File a BOC-3 form with the FMCSA, and designate a processing agent for each state in which you plan to operate.

- Get a Unified Carrier Registration (UCR).

Your business may also be required to obtain public liability insurance (BMC-91 or BMC-91X) and proof of cargo liability insurance (BMC-34 or BMC-83).

- Public liability insurance may offer property damage, environmental restoration, and bodily injury coverage. It ensures the FMCSA that you have adequate insurance to cover the risk of transporting goods and people across state lines.

- Cargo liability insurance may help cover cargo you’re liable for.

People Also Ask…

Freight brokers act as intermediaries – negotiating transactions between freight forwarders or freight carriers and shippers. They don’t handle shipments or cargo directly. Freight brokers typically only operate within a single country.

Freight forwarders coordinate shipment transportation via third-party carriers, but they also store, package, handle, and consolidate freight directly. Unlike brokers, freight forwarders may operate internationally with the authorization granted by the FMCSA, transporting freight legally across borders.

A single company may or may not manage both roles.

Freight broker bonds are sometimes called ICC broker bonds. However, the ICC (Interstate Commerce Commission) ended in the mid-90s, and the FMCSA took over.

The FMCSA requires freight brokers to acquire a $75,000 freight broker bond (BMC-84) before they may be licensed to operate. The bond ensures that brokers comply with their operating authority – the FMCSA – and run their businesses honestly and ethically.

To verify the status of your freight broker surety bond and license, visit the FMCSA Licensing and Insurance Public website and enter your USDOT or MC number. On the following page, navigate to the last column, click “view details,” and select the PDF report. In the “insurance type” field for your bond, you’ll see the status. If it says “yes,” you have “insurance on file,” your bond is active.

You can expect lower bond rates with a higher credit score (and vice versa). As your credit score increases or decreases year after year, your bond premiums may change. Credit score changes, surety underwriting guidelines, and public records and collections on your credit report can affect your renewal premiums.

While you don’t need an active MC number before beginning your freight broker bond application, you will need it to file your bond with the FMCSA. If you fall into any of the following broker categories, you will need an MC number and a DOT number:

- Brokers transporting (or arranging for the transport of) passengers in interstate commerce

- Brokers transporting (or arranging for the transportation of) federally regulated commodities in interstate commerce

- For-hire carriers

A USDOT Number is a unique identifier for monitoring and collecting a business’s safety information obtained during audits, crash investigations, compliance reviews, and inspections. To get your USDOT Number, you can register online using the Unified Registration System. Find out if you need a DOT Number.

If all the information you submit in your application is correct and complete and you meet all the FMCSA’s registration requirements, you should qualify for a bond – even with a lower credit score.

If an FMCSA-regulated entity changes its name or address (or other record details), it must promptly update its USDOT and operating authority record.

You’re required to update your information every two years – even if you shut down your business, cease interstate operations, or haven’t changed any data since the previous update. If you fail to complete your “Biennial Update,” your USDOT number may be deactivated, and you may face civil penalties of up to $1,000 per day.

You can make updates for free online using your USDOT number, EIN/SSN, assigned PIN, and Company Official information. You can also view upcoming filing deadlines.

How to Get a Freight Broker Surety Bond

We can help you find the right surety bond for your freight broker business and file it with the FMCSA for you. ZipBonds offers the fastest and most secure option for getting bonded. Our all-digital platform is intuitive and straightforward. Apply online or call us at 888-435-4191 to speak with an agent directly.

About ZipBonds.com

Founders Ryan Swalve and Zach Mefferd formed the vision for ZipBonds.com when they realized how overly complicated it was to help clients place surety. The frustration of being unable to incorporate the technology they’d used in other insurance-focused projects left them thinking “there has to be a better way.”

Fast forward a couple of years, and that better way is the impetus of everything we do at ZipBonds. We constantly look for innovative ways to improve the bonding process for our clients and agents. Our team comprises individuals who understand all angles of surety – for companies, agencies, and individuals. Incorporating everyone’s point of view to improve the process while simultaneously integrating cutting-edge technology is what sets our business apart.