Employee Dishonesty Bonds

What are employee dishonesty bonds?

An employee dishonesty bond is a type of fidelity bond (insurance policy) for businesses. It helps protect companies and business owners by guaranteeing financial compensation if an employee or non-employee steals money, property, or securities or commits fraud. The business must provide proof of loss to collect.

This bond is commonly confused with business service bonds – used to protect a business’s customers from employee theft. Learn more in our Business Services Bonds Guide.

Get Your Employee Dishonesty Bond:

Quick Takeaways

- Employee dishonesty bonds protect companies from employee and non-employee theft and fraud.

- An employee dishonesty bond isn’t required by law but can be a wise and affordable safeguard for businesses of all sizes.

- The bond amount you purchase will depend on the coverage you need for potential losses and the number of employees you have.

What are “common insuring agreements” for this bond?

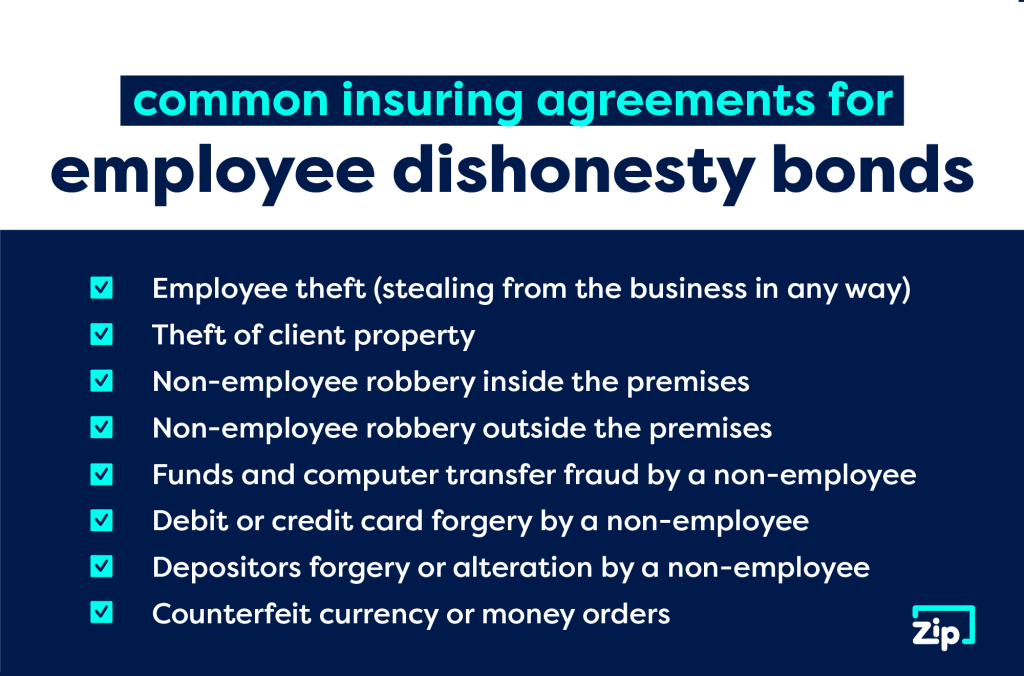

An employee fidelity bond provides insurance coverage for the following scenarios:

- Employee theft (stealing from the business in any way)

- Theft of client property

- Non-employee robbery inside the premises

- Non-employee robbery outside the premises

- Funds and computer transfer fraud by a non-employee

- Debit or credit card forgery by a non-employee

- Depositors forgery or alteration by a non-employee

- Counterfeit currency or money orders

How do employee dishonesty bonds work?

An employee dishonesty bond isn’t required by law but can be a shrewd and affordable safeguard for businesses of all sizes. Protect your business against employee theft, fraud, embezzlement, and more.

If someone steals from you, you can file a claim against the bond. If the surety company determines the claim is valid – after investigation – you will be compensated for your losses up to the total bond amount.

While no business owner wants to imagine their employees stealing from them, it happens often. One survey found that 95% of businesses have been hurt by employee theft. Another indicates that 75% of employees in the U.S. (of industries surveyed) have stolen from their employer at least once. You can provide additional protection for yourself and your business with a surety bond.

How much do employee dishonesty bonds cost?

Your bond premium will depend on the coverage you need for potential losses and the number of employees you have. You will pay a small percentage of the bond amount required to purchase your bond. We can issue these types of bonds quickly for as low as $100 per year.

Apply for Your Employee Dishonesty Bond

The experts at ZipBonds can help you obtain the bond you need. To connect with one of our team members, please give us a call at 888-435-4191 or email us at support@zipbonds.com. We’ll walk you through the process for fidelity bonds to help you get bonded in a flash.

About ZipBonds.com

Founders Ryan Swalve and Zach Mefferd formed the vision for ZipBonds.com when they realized how overly complicated it was to help clients place surety. The frustration of being unable to incorporate the technology they’d used in other insurance-focused projects left them thinking “there has to be a better way.”

Fast forward a couple of years, and that better way is the impetus of everything we do at ZipBonds. We constantly look for innovative ways to improve the bonding process for our clients and agents. Our team comprises individuals who understand all angles of surety – for companies, agencies, and individuals. Incorporating everyone’s point of view to improve the process while simultaneously integrating cutting-edge technology is what sets our business apart.