If you’re required to obtain a surety bond, you’ll need to fill out a form as part of the process. A surety bond form is a legal document that outlines the bond’s terms, including the amount, the obligation the principal agrees to complete, and the conditions under which the surety company will be liable if the principal breaks the agreement at any point.

If you’re new to surety bonds or just need a refresher on the process, you’ve come to the right place. In this guide, we’ll walk you through how to complete a surety bond form – step by step. We’ll also give you a preview of what to expect if you fill out an application on our website. (Hint: It’s super quick and easy!)

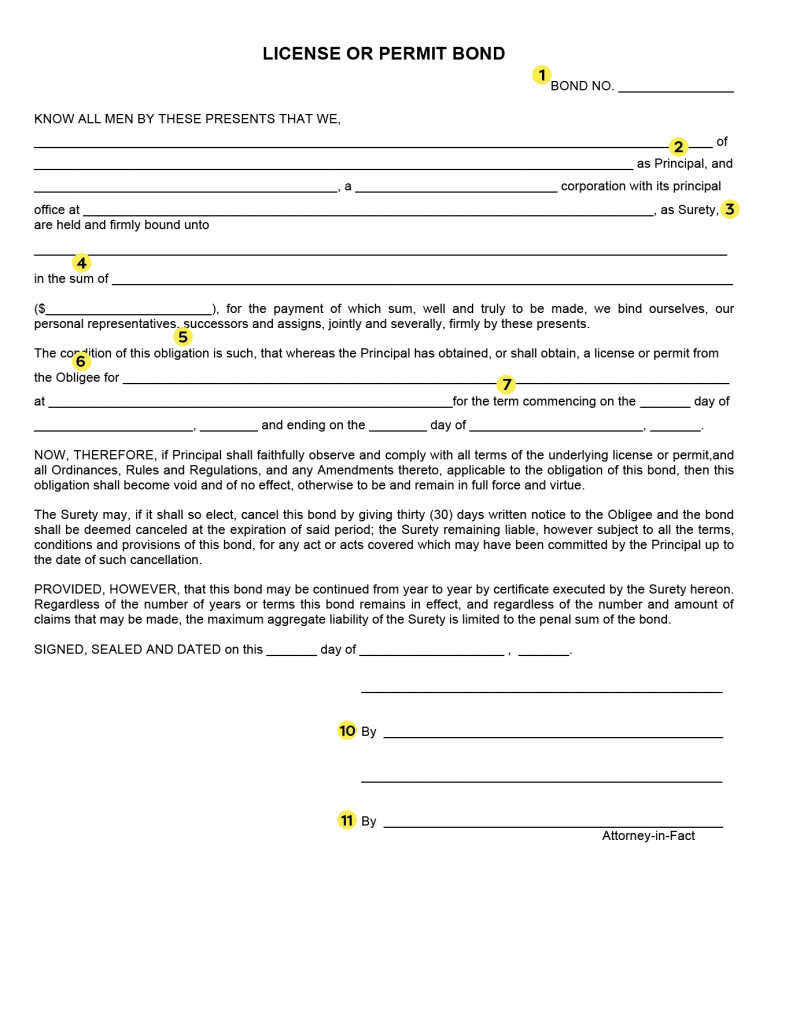

Anatomy of a Surety Bond Form

Let’s start by reviewing the different sections of a physical surety bond form. Your form may vary depending on the type of bond you need, but these are the general terms you’ll come across and need to understand to get the job done.

1. Bond Number

The surety company assigns this unique identifying number to the bond. The obligee or surety provider you’re working with should provide the bond form.

2. Principal

The principal is the person or business required to obtain the bond. (If you’re filling in the form for your business, this is likely you!)

3. Surety Company

The surety is the insurance company that issues the bond and guarantees payment if the principal fails to fulfill their obligations. They will seek full reimbursement from the principal for any amount they pay out to a claimant on the principal’s behalf.

4. Bond Penalty (Penal Sum)

The bond penalty is the maximum amount of money a surety company will pay out to a claimant if there’s a valid claim. In other words, it’s the total amount the principal could be responsible for.

If you break your bond contract, someone could file a claim against the bond up to the bond penalty amount.

5. Obligation

The obligation encompasses the purpose and conditions of the bond.

6. Obligee

The obligee is the entity that requires the bond to protect against potential losses or damages. This is usually a project owner or government agency.

7. Effective Term

This includes the start and end dates of the bond’s coverage. If you need your bond for longer than this date range, you must renew it before it expires for it to remain active.

8. State

This refers to the state where the bond is being issued.

9. Bond Premium

The bond cost, usually calculated as a percentage of the bond amount, is called a premium. In some cases, the premium will be a flat rate for all applicants.

10. Principal Signature

You must sign the bond form where it says “principal signature” before submitting the bond to your obligee.

11. Surety Signature

A surety company representative must also sign the bond for it to be valid. The person appointed to enforce or execute the surety bond on behalf of the surety company is often called an “attorney-in-fact.”

How to Fill Out an Online Surety Bond Form [The ZipBonds Way]

Now let’s cover the process of filling out an online form on our website. We want to clear up any potential confusion so you can get what you need as easily and quickly as possible.

1. Find the correct bond form.

Ensure you have the correct form for your specific bond type and state. With ZipBonds, you can easily find your bond using our online search tool. If you can’t find the exact form you need, don’t sweat it. You can always start with a generic form (like this one), and we’ll contact you if we need any additional information.

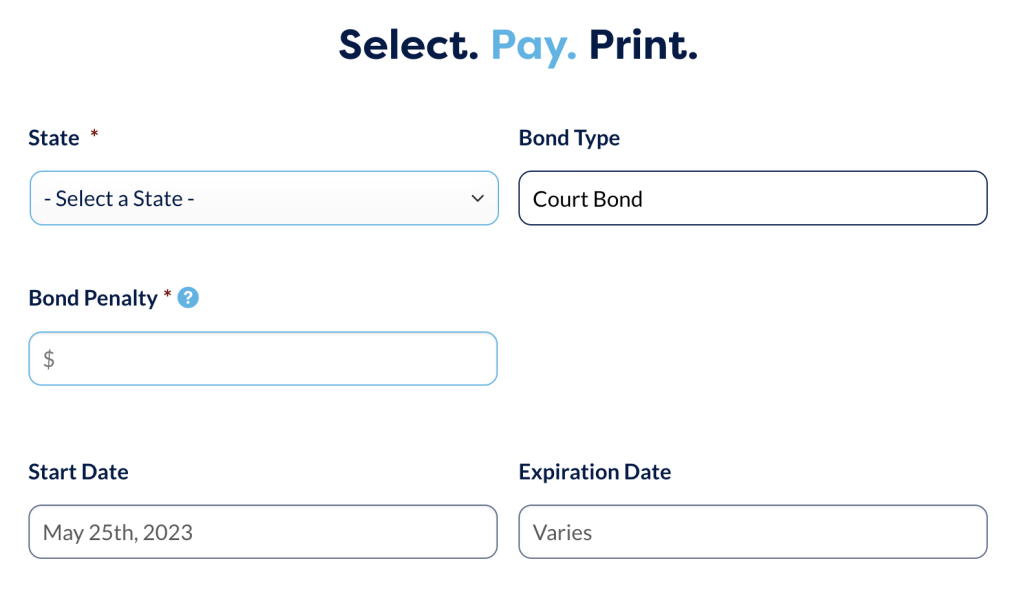

Court Bond Example

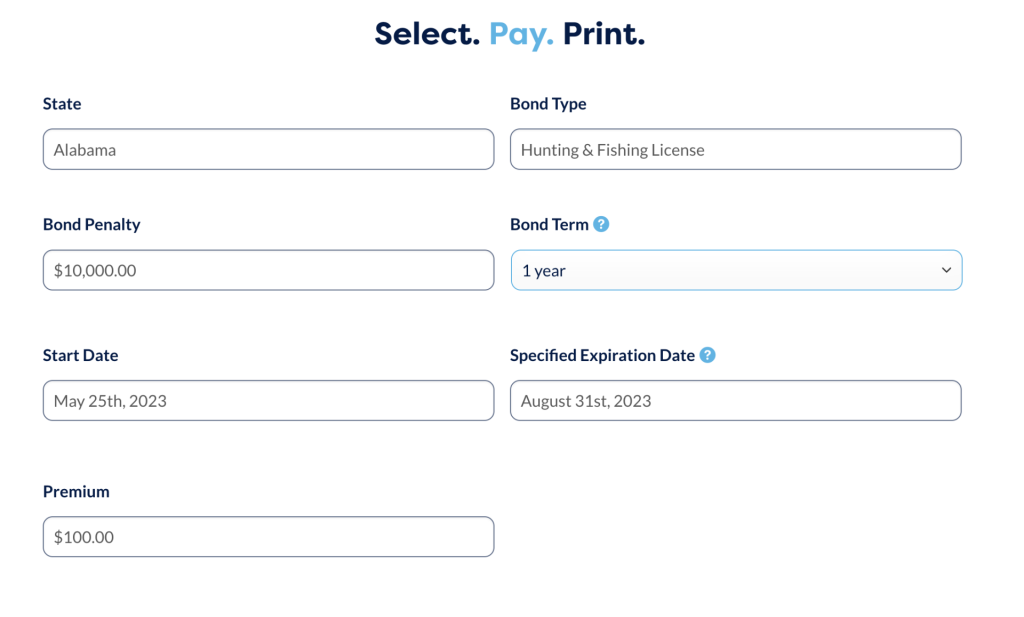

2. Fill in the bond information.

Next, you’ll fill in essential information like your state, bond type, bond penalty, and start and end dates. You can get this information from your obligee or ask us for help if you’re unsure.

If the form is in our system, it will likely auto-fill various fields, such as the state, bond type, bond penalty, start and end dates, and premium amount. This makes it fast and easy to complete the application.

Alabama Hunting and Fishing License Bond Example

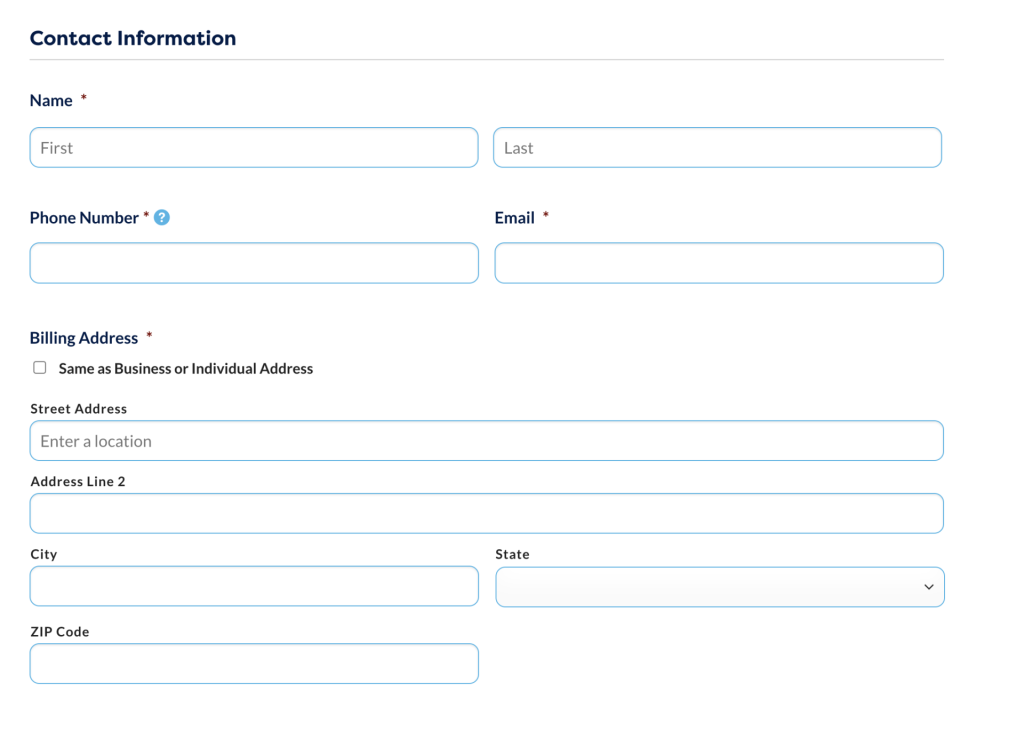

3. Fill in the principal information.

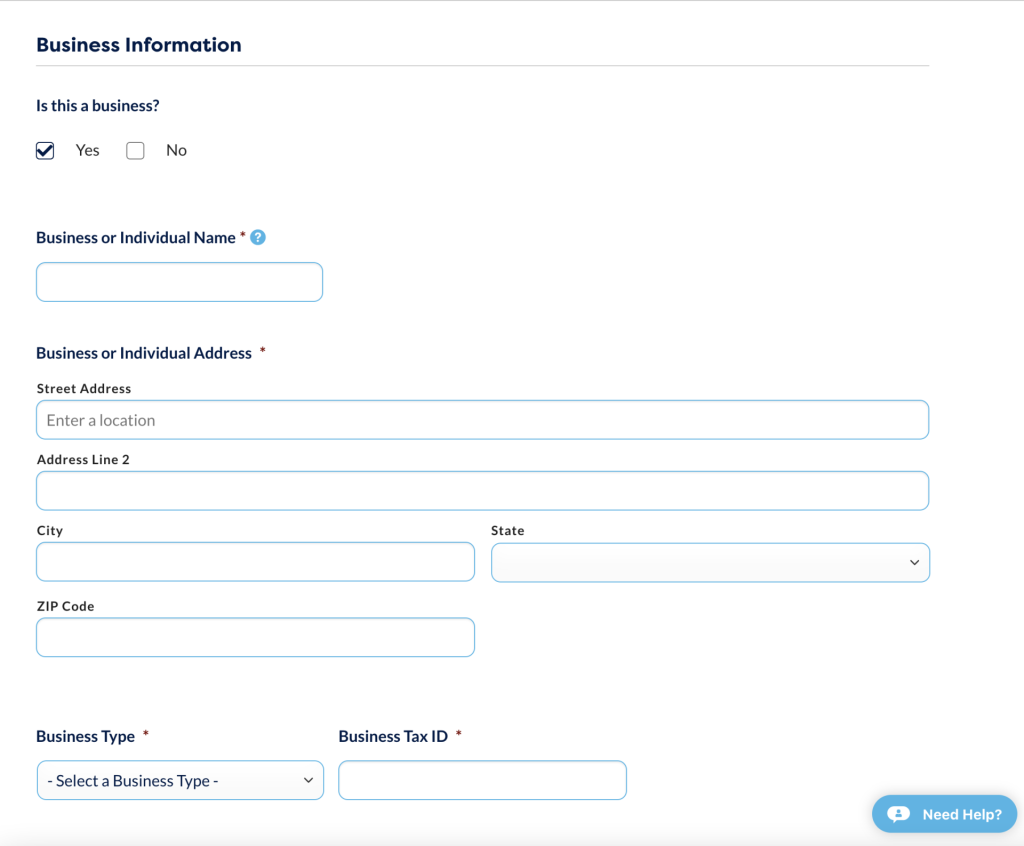

Next, you’ll have to fill out the information about the person (and business, if applicable) required to obtain the bond. This includes basic contact information like your name, phone number, email address, and physical address for billing. Depending on the form, you may also need to provide additional details like your business type, tax ID, and other information pertaining to the bond.

Basic Contact Info

Business Info

4. Submit your application.

Some bond applications are instantly approved through our website, while others may require review (and things like credit checks). If we can instantly issue your bond, we’ll have the premium listed on the form and have an option for you to pay right then and there. Then we’ll email you your bond so you can print it, sign it, and send it to your obligee!

If we need to review your application before issuing your bond, one of our agents follow up with you posthaste using the contact info you provided. This could take anywhere from a few minutes to a couple of hours.

If you purchase your bond through ZipBonds, we’ll keep track of when it’s time to renew (if necessary) so that you don’t miss the deadline. One of our agents will reach out a couple of months before your bond expires.

Bond Form Definitions Explained

Here’s where we start getting into the nitty gritty. If you’re wondering what some of the following terms from your form mean, you can use this as your glossary go-to:

- Cancellation clause: This clause allows the surety company to cancel the bond under certain circumstances, such as if the principal fails to pay the bond premium or breaches the bond terms. It also allows the principal to cancel before the bond term ends, listing the cancellation terms, such as the notice period and the reasons for cancellation.

- Statutes/legal requirements: This refers to the laws and regulations that govern the specific industry or activity for which the surety bond is required.

- Aggregate liability clause: This clause specifies the maximum amount of liability that the surety will assume for all claims made against the bond during the bond’s term, regardless of the number of claims or their individual amounts.

- Issued immediately: This means a bond can be issued without a waiting period or underwriting process. Some types of bonds, such as auto dealer bonds, are often issued immediately, while others may require more time for underwriting.

- Effective date: This is when the bond becomes valid and the surety’s obligation to the obligee begins.

- Bond amount: The bond amount is how much coverage the bond provides. It’s the maximum amount the surety will pay out for claims against the bond.

- Underlying agreement: Refers to the primary contract or obligation that the bond is meant to guarantee. For example, a construction contract may require a performance bond to ensure the contractor completes the agreed-upon project.

- Financial and credit statements: This section of the bond form may require you to provide financial and credit statements to the surety company as part of the underwriting process.

- Indemnity of the principal: This clause states that the principal agrees to indemnify (reimburse) the surety company for any losses incurred due to the principal’s failure to fulfill their obligations.

Get Bonded with ZipBonds Today

Our goal is to make the bonding process as fast, secure, and painless as possible. Our process is all about speed, and most of our bonds can be approved and processed immediately from our site. If you have any questions about the application process or would like to apply over the phone with one of our agents, please give us a call at (888) 435-4191.