Construction Bonds: What Every Contractor Needs to Know [An Infographic]

Whether you’re bidding on your first public project or expanding your private sector portfolio, understanding construction bonds is essential to protecting your business and winning work. At ZipBonds, we know that navigating bonding requirements can be overwhelming, so we created a simple, visual guide to walk you through the essentials.

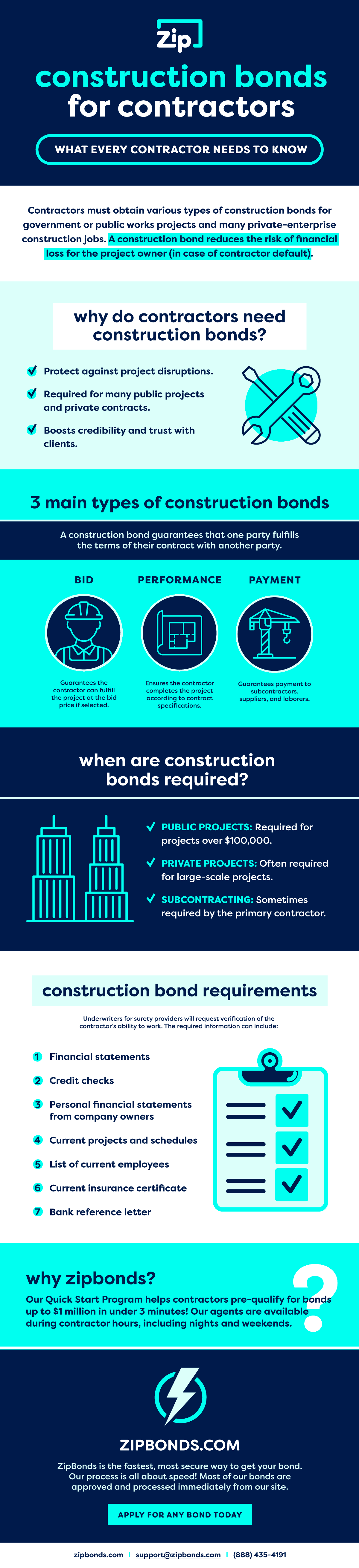

Our new infographic, Construction Bonds: What Every Contractor Needs to Know, breaks down the key types of contract bonds — when they’re required, how to get bonded, and the major benefits they offer contractors like you. Plus, we explain how ZipBonds can help you secure bonding quickly and efficiently, so you can focus on what you do best.

Use this infographic to quickly learn how getting bonded can open doors to bigger projects, stronger client relationships, and long-term success in the construction industry.

What is a construction bond?

Construction bonds are financial guarantees that ensure project completion and compliance with contract terms.

Why Contractors Need Them

- Protect against project disruptions.

- Required for many public projects and private contracts.

- Boosts credibility and trust with clients.

Types of Construction Bonds

- Bid Bond: Guarantees the contractor can fulfill the project at the bid price if selected. Protects the project owner if the contractor backs out.

- Performance Bond: Ensures the contractor completes the project according to contract specifications. Protects against subpar work or project abandonment.

- Payment Bond: Guarantees payment to subcontractors, suppliers, and laborers. Prevents liens from unpaid parties.

- Maintenance Bond: Provides a warranty for workmanship and materials after project completion.

When are construction bonds required?

- Public Projects: Almost always required.

- Private Projects: Often required for large-scale projects.

- Subcontracting: Sometimes required by the primary contractor.

How to Get Bonded (Step-by-Step Process)

- Application Submission: Provide business and financial details.

- Underwriting Review: Credit check, financial history, and project scope are assessed.

- Quote & Agreement: Receive bond terms and costs.

- Issuance of Bond: Once approved, the bond is issued, and you are ready to bid or start the project.

Key Benefits for Contractors

- Increased Credibility: More trust from clients and project owners.

- Access to Bigger Projects: Many government and large-scale projects require bonds.

- Protection Against Financial Losses: Covers risks of non-payment or project failure.

Why ZipBonds?

Our Quick Start Program helps contractors pre-qualify for bonds up to $1 million in just 3 minutes! If you require a larger bonding capacity, fill out a short form, and we’ll reach out promptly to gather more information to process your bond as fast as possible.